The Richest Countries In Europe 2025

Europe is home to some of the most affluent and innovative economies in the world, each shaped by its unique geography, history, and policy choices. From global financial centers to resource-rich Nordic nations, the continent’s wealthiest countries consistently lead in terms of GDP per capita (PPP). Many of these states are relatively small in size or population, yet they rank among the world’s economic powerhouses thanks to strategic economic policies, diversification, and international trade.

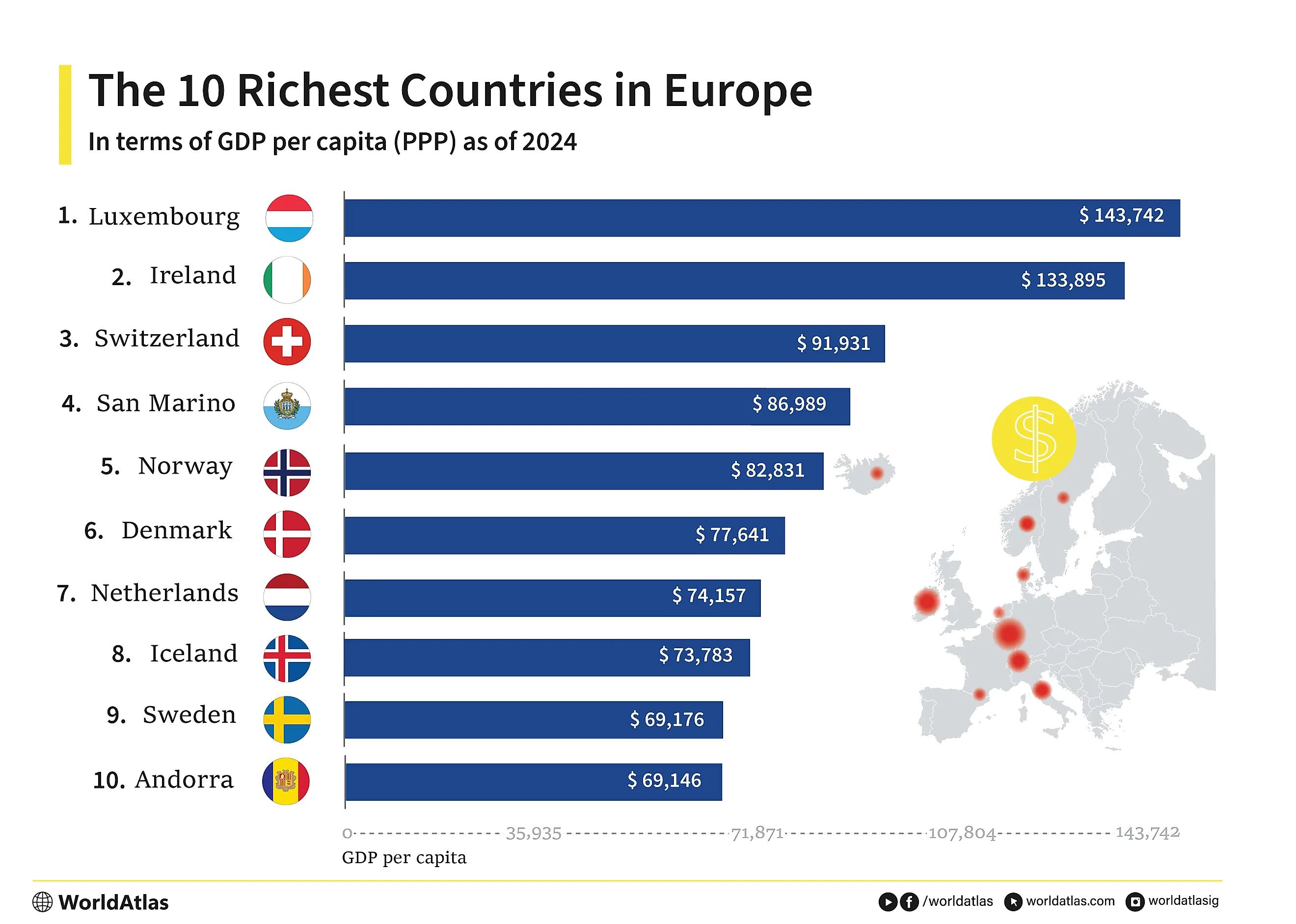

Below is a closer look at the ten richest European countries by GDP per capita (PPP) projected for 2025. You’ll see recurring themes such as specialized industries (financial services, pharmaceuticals, technology), strong welfare systems, robust infrastructure, and innovation-driven approaches to sustain growth. This year, Liechtenstein, Luxembourg, and Ireland rank as the three richest countries in Europe with a GDP/Capita in PPP of $201,112, $152,394, and $147,878, respectively.

Let’s begin with tiny Liechtenstein, whose extraordinary GDP per capita far outstrips larger economies.

10 Richest Countries In Europe

| Rank | Country | GDP/Capita USD (PPP) |

|---|---|---|

| 1 | Liechtenstein | $201,112.30 |

| 2 | Luxembourg | $152,394.60 |

| 3 | Ireland | $147,878.20 |

| 4 | Norway | $106,694.10 |

| 5 | Switzerland | $97,659.28 |

| 6 | Denmark | $84,762.88 |

| 7 | Netherlands | $84,035.22 |

| 8 | San Marino | $82,886.41 |

| 9 | Iceland | $80,466.38 |

| 10 | Malta | $78,710.89 |

1. Liechtenstein - $201,112 GDP/Capita (PPP)

Liechtenstein is Europe’s richest country thanks to a high-value, export-oriented economy anchored in advanced manufacturing and finance. With an IMF-estimated 2025 GDP per capita of about $201,110 (PPP) and $231,713 (nominal), it tops global rankings.

Industry accounts for roughly 42% of output, led by precision firms in electronics, dental products, optics, and specialty machinery (think Hilti), while services, especially finance, provide scale and profitability. A customs union with Switzerland, use of the Swiss franc, EEA/EFTA access, and passport-free Schengen travel give the microstate seamless market integration and monetary stability. The workforce is highly skilled and flexible, augmented by thousands of daily cross-border commuters, keeping unemployment near 1% and supporting dense SME clusters. Conservative public finances, AAA credit ratings, low VAT aligned with Switzerland, and strong rule of law attract investment. Heavy R&D spending and close links to neighboring economies sustain productivity, resilience, and high living standards despite the country’s tiny size.

2. Luxembourg - $152,394 GDP/Capita (PPP)

Luxembourg is Europe’s second-richest country in 2025, with GDP per capita around $152,915 (PPP). Its small, open economy is dominated by services, especially a globally connected financial centre spanning banking, funds, and insurance. EU single-market access, a large cross-border workforce, and prudent supervision support scale far beyond its size. The country’s pivot from steel to finance and high-value services has stuck, while adjacent tech niches have flourished, most visibly SES, the Betzdorf-based satellite operator that underscores Luxembourg’s growing space and telecoms ecosystem.

Solid fundamentals underpin its ranking: AAA sovereign ratings, low public debt, and steady employment augmented by commuters from neighbouring countries. Transparency reforms have strengthened credibility without dulling competitiveness, and modern space-activity laws keep investment flowing. Living standards are exceptionally high, though housing costs and an elevated at-risk-of-poverty rate remain policy challenges. Overall, Luxembourg’s blend of a deep financial hub, advanced infrastructure, and skilled, multilingual talent keeps it firmly among Europe’s wealth leaders, just shy of the top spot in 2025.

3. Ireland - $147,878 GDP/Capita (PPP)

Ireland is Europe’s third-richest country in 2025 by GDP per capita (PPP), behind Liechtenstein and Luxembourg. The IMF’s 2025 numbers put Ireland around $147,878 (PPP) per person, reflecting a knowledge-intensive mix of pharma, medtech, software, finance, and agrifood, with exports and productivity amplified by multinational enterprises.

Because multinationals can distort headline GDP, Ireland’s statistics office created Modified GNI (GNI*) to better track the domestic economy. Investment momentum remains firm: IDA reported 179 new projects and commitments for 10,000 jobs in the first half of 2025, heavily focused on R&D-rich tech and life sciences.

Public finances are unusually strong: a 2024 general-government surplus of about 4.3% of GDP and debt easing to roughly 41% of GDP, supported by robust corporate-tax receipts from multinationals. Social challenges persist, especially housing pressures, but the at-risk-of-poverty rate was 11.7% in 2024, below the EU average. Overall, openness, deep FDI links, and stable institutions keep Ireland firmly among Europe’s wealth leaders.

4. Norway - $106,694 GDP/Capita (PPP)

Norway is among Europe’s wealth leaders in 2025, typically ranked fourth by GDP per capita (PPP) behind Liechtenstein, Luxembourg, and Ireland. IMF projections put Norway around $107k (PPP) per person, with totals near $600bn (PPP) and $517bn (nominal). The economy remains a classic mixed model with significant state stakes and an energy backbone, but it’s broad: services account for ~52% of value added, industry ~37% (including oil and gas), and agriculture ~2%.

Strong public finances underpin this prosperity (Norway kept a double-digit fiscal surplus in 2024) and sovereign credit stays AAA across major agencies. The nearly $2 trillion Government Pension Fund Global smooths commodity cycles; withdrawals follow a ~3% real-return guideline.

Outside the EU, Norway accesses the single market via the EEA, supporting an export base led by petroleum, gas, and seafood, with the U.K., Germany, and the Netherlands key partners. The wealth fund’s rising allocations to grids and transition assets, such as stakes linked to TenneT and Brookfield’s energy-transition fund, illustrate diversification beyond hydrocarbons while reinforcing long-run income.

5. Switzerland - $97,659 GDP/Capita (PPP)

Switzerland remains among Europe’s wealth leaders in 2025. On IMF figures, GDP per capita (PPP) is about $97-98k, typically placing it fifth in Europe behind Liechtenstein, Luxembourg, Ireland, and Norway. It also tops the Global Innovation Index again this year and has the world’s highest average personal wealth per adult.

Prosperity rests on a broad, high-value mix: chemicals and pharmaceuticals now account for just over half of merchandise exports, alongside precision machinery, medtech, watches, and a sophisticated financial centre. Stability is anchored by AAA sovereign ratings and a cautious central bank stance, with the SNB holding policy at 0% in late-2025.

Macro fundamentals are solid: low public debt at the federal level, a record 2024 trade surplus carried into 2025, and unemployment near 2.8% by August. Post-merger banking reforms and UBS’s ongoing integration of Credit Suisse aim to bolster resilience without dulling competitiveness, reinforcing Switzerland’s place among Europe’s richest, most innovative economies.

6. Denmark - $84,762 GDP/Capita (PPP)

Denmark remains firmly in Europe’s top tier in 2025, ranking 6th by GDP per capita (PPP). IMF figures put it near $85k per person, reflecting a highly productive, export-oriented economy anchored in pharmaceuticals, wind energy, maritime services, and advanced manufacturing. A deep skills base and strong institutions help sustain high living standards and steady growth.

Macro stability is a hallmark. The krone’s long-standing peg to the euro keeps exchange-rate volatility low, while public finances are among the EU’s strongest: the European Commission projects a general-government surplus in 2025 and gross debt below 30% of GDP, alongside a double-digit current-account surplus. Together, these buffers support resilience even as the global cycle shifts.5

Growth drivers have broadened. Pharma remains powerful, but 2025 also benefits from renewed North Sea gas extraction and solid industrial production. Denmark continues to lead in green technologies, think turbines and grid solutions, while shipping and food processing add breadth. With stable policy, flexible labour markets, and high employment, Denmark’s model blends competitiveness with comprehensive public services, keeping it securely among Europe’s wealth leaders.

7. Netherlands - $84,035 GDP/Capita (PPP)

The Netherlands remains in Europe’s wealth elite in 2025. IMF estimates put nominal GDP around $1.32 trillion and income near $85k (PPP) per person. Prosperity leans on trade and logistics, with Rotterdam, still Europe’s largest seaport, handling 211 million tonnes in 1H 2025 despite softer bulk volumes and a modest container rebound.

High productivity and external strength underpin the model: the current-account surplus was revised to ~9% of GDP for 2024. A deep tech base adds heft, ASML’s world-leading lithography equipment anchors the semiconductor value chain, while Amsterdam’s tech scene keeps scaling, including Netflix’s EMEA headquarters. Together, these engines support high incomes and Europe-leading competitiveness.

Energy policy is shifting decisively: a 2024 law permanently closed the Groningen gas field, accelerating the move away from domestic gas. Even with tighter export controls on advanced chip tools, the Netherlands stays open, rules-based, and attractive for investment, helping keep it firmly among Europe’s richest economies in 2025.

8. San Marino - $82,886 GDP/Capita (PPP)

San Marino remains one of Europe’s wealthiest microstates in 2025, with GDP per capita around $83,000 (PPP). Its compact economy blends tourism, private banking, and small-scale manufacturing (ceramics, apparel, furniture, wine). The euro, used under a formal monetary agreement, anchors monetary stability, and limited-mintage euro coins provide a niche revenue stream alongside steady visitor flows.

The financial sector has materially stabilised since the post-2008 shock. System-wide clean-ups, including large securitisations and write-offs completed in 2023, have cut bad loans sharply: net NPLs fell to ~12% by March 2025 (from 27.8% at end-2022). Balance sheets are firmer, though legacy costs still weigh on public finances, keeping fiscal consolidation on the agenda.

Integration with Europe keeps deepening. San Marino operates a customs union with the EU and uses the euro; in October 2025 the EU signed updated protocols to expand the automatic exchange of financial account information, and a broader EU association agreement moved forward in 2024. Together with high-value services and proximity to Italy’s markets, these steps help sustain San Marino’s high incomes by regional standards.

9. Iceland - $80,466 GDP/Capita (PPP)

Iceland remains among Europe’s wealthiest in 2025, with an IMF GDP per capita of around $80,000 (PPP). Growth is projected to pick up to 1.6% after a soft 2024 as inflation eases; the Central Bank’s key rate stands at 7.5% (October). Tourism contributed 8.1% of GDP in 2024, alongside fisheries, aluminium, and growing digital services.

Market reforms in the 1990s and the post-2008 restructuring left a smaller, better-supervised financial system and a flexible, export-oriented economy. Prudent macro policy and the krona help absorb shocks. National accounts show first-half 2025 GDP up 0.3% year on year, signalling stabilisation despite global headwinds.

Prosperity is increasingly underpinned by near-100% renewable electricity from hydropower and geothermal, keeping energy-intensive industry competitive while supporting new green projects. Iceland also shapes the wellbeing-economy agenda as a member of WEGo and host of the 2025 Wellbeing Economy Forum in Reykjavík, aligning growth with quality of life.

10. Malta - $78,710 GDP/Capita (PPP)

Malta remains an advanced, high-income EU economy in 2025, with IMF-estimated GDP per capita around $79k (PPP). A tight labour market supports living standards: the unemployment rate was 2.9% in August 2025, among the lowest in the EU. Strategic location and English-speaking talent underpin its role as a regional hub.

The growth mix is services-led, finance, ICT, and iGaming, augmented by high-value manufacturing and aviation maintenance. Semiconductors are a standout: STMicroelectronics’ Kirkop site is officially recognised as the EU’s first advanced manufacturing backend plant, highlighting Malta’s niche in sophisticated electronics and packaging.

Tourism has roared back: 2024 set a record with 3.56 million visitors, and momentum carried into 2025 (e.g., July arrivals up 6.2% year-on-year to 405,263). Public finances remain sound by EU standards; the European Commission sees the deficit narrowing after 2024 and debt stabilising below ~48% of GDP. Combined with strong external links and a pro-business environment, these pillars keep Malta securely among Europe’s wealthier economies in 2025.

Countries In Europe Ranked By GDP/Capita in PPP

| Rank | Country | GDP/Capita USD (PPP) |

|---|---|---|

| 1 | Liechtenstein | $201,112.30 |

| 2 | Luxembourg | $152,394.60 |

| 3 | Ireland | $147,878.20 |

| 4 | Norway | $106,694.10 |

| 5 | Switzerland | $97,659.28 |

| 6 | Denmark | $84,762.88 |

| 7 | Netherlands | $84,035.22 |

| 8 | San Marino | $82,886.41 |

| 9 | Iceland | $80,466.38 |

| 10 | Malta | $78,710.89 |

| 11 | Belgium | $75,882.37 |

| 12 | Austria | $74,852.29 |

| 13 | Germany | $73,553.30 |

| 14 | Sweden | $73,069.51 |

| 15 | Andorra | $72,359.32 |

| 16 | Finland | $66,512.47 |

| 17 | France | $66,060.53 |

| 18 | United Kingdom | $63,759.05 |

| 19 | Italy | $63,125.68 |

| 20 | Czech Republic | $59,853.14 |

| 21 | Slovenia | $57,716.48 |

| 22 | Lithuania | $57,201.43 |

| 23 | Spain | $56,887.93 |

| 24 | Poland | $55,340.22 |

| 25 | Croatia | $51,453.31 |

| 26 | Portugal | $49,753.19 |

| 27 | Estonia | $49,087.45 |

| 28 | Russian Federation | $49,048.99 |

| 29 | Romania | $48,847.46 |

| 30 | Hungary | $48,156.87 |

| 31 | Slovak Republic | $47,596.54 |

| 32 | Greece | $44,985.38 |

| 33 | Latvia | $44,105.52 |

| 34 | Bulgaria | $42,477.29 |

| 35 | Montenegro | $34,407.85 |

| 36 | Belarus | $34,069.08 |

| 37 | Serbia | $32,741.87 |

| 38 | North Macedonia | $29,509.92 |

| 39 | Albania | $23,327.05 |

| 40 | Bosnia and Herzegovina | $22,829.68 |

| 41 | Ukraine | $20,903.94 |

| 42 | Moldova | $19,590.73 |

| - | Monaco | no data |

Discover More Rich Countries

The Richest Countries In The World

Liechtenstein, Singapore, and Ireland rank as the three richest countries in the world for 2025 with a GDP/Capita in PPP of $201,112, $152,394, and $147,878, respectively.

The Richest Countries In Asia

Singapore, Qatar and Brunei are currently the richest countries in Asia for 2025, with GDP/Capita in PPP of $156,969, $122,283, and $94,472, respectively.

The Richest Countries In North America

The United States, Canada, and Panama are the richest countries in North America for 2025, with GDP/Capita in PPP of $89,598, $65,500, and $43,651, respectively.

The Richest Countries In South America

Guyana, Uruguay, and Chile are the richest countries in South America for 2025, with GDP/Capita in PPP of $94,189, $37,190, and $35,286, respectively.

The Richest Countries In Africa

Seychelles, Mauritius, and Gabon are the richest countries in Africa for 2025, with GDP/Capita in PPP of $42,110, $33,023, and $24,738, respectively.

The Richest Countries In South Asia

The Maldives, Bhutan, and India are the richest countries in South Asia for 2025, with a GDP/Capita in PPP of $36,065, $17,721, and $12,100, respectively.