Top 10 Steel Producing Countries In The World

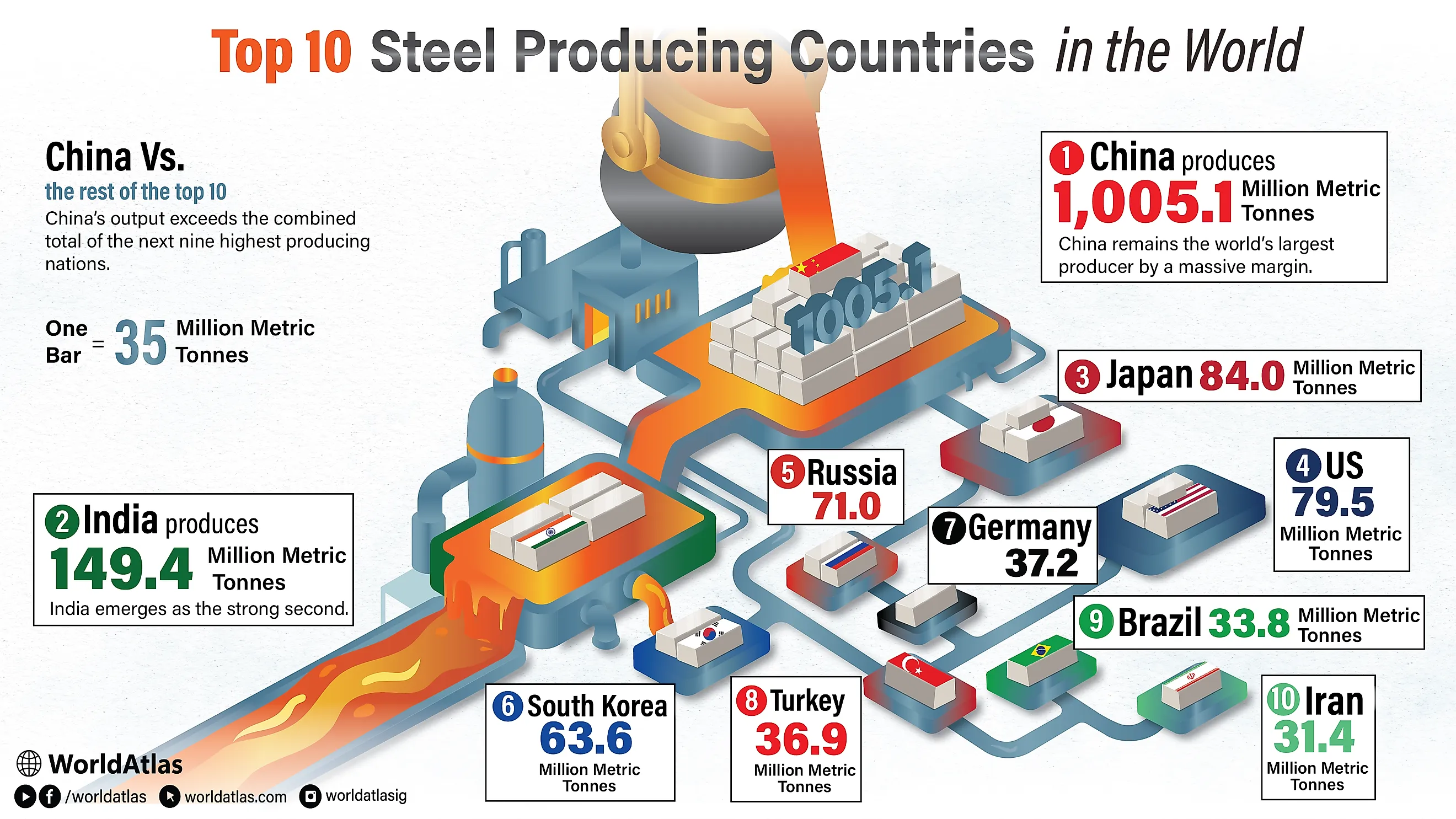

Steel is an essential metal for human civilization, used for a wide range of purposes throughout history. From medical equipment to kitchen utensils, steel is used across industries, and demand continues to grow. Hand in hand with demand, steel production is also growing rapidly, and some countries stand out in this regard. China is the largest steel producer as of 2024, producing 1,005.1 million tonnes (crude steel) that year. This is around half of the world’s total production, making it a strong player in global supply. Apart from China, the other largest steel-producing countries in the world are India, Japan, the United States, Russia, South Korea, Germany, Turkey, Brazil, and Iran.

In total, these ten countries produce over 1,500 million tonnes, underscoring the significant demand for steel and China’s prominence. This article lists the top 10 steel-producing countries in the world based on their 2024 production and details how much steel each produces. It also details the steel industry in each country and its history.

The Top Ten Steel Producing Countries In The World

| Rank | Country | Crude Steel Production (2024, million tonnes) |

|---|---|---|

| 1 | China | 1,005.1 |

| 2 | India | 149.4 |

| 3 | Japan | 84 |

| 4 | United States | 79.5 |

| 5 | Russia | 71 |

| 6 | South Korea | 63.6 |

| 7 | Germany | 37.2 |

| 8 | Turkey | 36.9 |

| 9 | Brazil | 33.8 |

| 10 | Iran | 31.4 |

1. China — 1,005.1 Million Tonnes

China is by far the largest producer of steel, producing 1,005.1 million tonnes of crude steel in 2024. This is around 50% of global production and nearly seven times that of the second-largest producer, India. Surprisingly, production is down slightly from 2023’s figure of 1028.9 tonnes due to a drop in domestic demand and government caps. China’s steel industry is also one of the fastest-growing. In the early 1900s, it was not a global competitor and relied on Soviet technology. In the 1950s, the country’s Five-Year Plan made steel a priority, and continuous growth made it the world’s largest steel producer before the 21st century.

In addition to being the largest producer of steel, China is home to Baowu Steel Group Corp., Ltd. (Baowu), the largest steel producer in 2024. The company is state-owned and produced over 130 million tonnes of crude steel in the year. Most of China’s steel production is used domestically, with estimates suggesting that over 85-90% is consumed within the country. The largest share goes to construction, infrastructure projects, and manufacturing, including machinery and automobiles. This prominent industry provides jobs to around three million people, making it one of the country’s largest sources of employment.

2. India — 149.4 Million Tonnes

India is one of the world’s largest producers of steel, with major global companies like Jindal Stainless, JSW Steel, and Bhushan Steel. Public sector giant SAIL is the largest producer, with annual output exceeding 16 million tonnes. Along with large conglomerates, around 50% of the country’s steel is produced by MSMEs (Medium and Small Enterprises), which are promoted by government schemes under the “Make In India” effort.

To this end, India has multiple mini-plants and over thirty integrated steel plants, which produced 149.4 million tonnes of crude steel in 2024. Plans are also set in place to promote steel production, with dozens of steel plants under construction, and states like Odisha aim to increase their production capacity to around 130 million tonnes within the decade. In total output, the government plans to increase production capacity to 300 million tonnes by 2030 and 500 million tonnes by 2047.

Along with being a global player, the steel sector is vital to India’s economy, accounting for about 2% of the nation’s GDP. Moreover, it employs over 600,000 people directly and millions indirectly. India also benefits from abundant iron ore reserves, which reduce reliance on imported raw materials and support the long-term expansion of domestic steel production.

3. Japan — 84 Million Tonnes

Japan is a major global steel producer, producing 84 million tonnes of crude steel in 2024, making it the third-largest steel-producing country in the world. The industry is led by companies such as Nippon Steel, JFE Holdings, and Kobe Steel, which together dominate domestic production. While much of Japan’s steel is consumed domestically, especially in construction and manufacturing, the country is also a major exporter. In 2024, Japan exported 31.1 million tonnes of steel to 121 countries and territories, accounting for just under half of its total output.

Although Japan’s total steel production has declined from its 2015 peak of 110.7 million tonnes, the country remains highly competitive due to its focus on high-grade and specialty steel. Japanese steel is widely used in the automotive, shipbuilding, machinery, and electronics industries, where quality and precision are critical. The sector continues to benefit from advanced production technology, strict quality standards, and skilled labor. Major firms such as Nippon Steel alone employ over 100,000 people, underscoring the industry’s ongoing economic importance despite lower overall volumes.

4. United States — 79.5 Million Tonnes

The United States of America is the world’s fourth-largest producer of steel, producing 79.4 million tonnes in 2024. This is just behind Japan, and it is thanks to the country’s robust structure of traditional integrated mills and mini-mills. The former processes iron ore into steel, while the latter melts scrap metal to produce new steel. There are over 100 mini-mills in the United States, producing the majority of the country’s steel. While it is one of the world’s largest steel industries, it employs only around 85,000 people, which is relatively low given its output.

The United States is also a significant player in global steel trade, though exports account for only a relatively small share of total output. In 2024, the U.S. exported about 8.0 million tonnes of steel, ranking 11th worldwide, with Canada and Mexico as its primary destinations. At the same time, steel imports account for roughly 25% of domestic consumption, reflecting strong internal demand. The U.S. steel industry is highly recycling-driven, processing over 60 million tonnes of scrap steel annually, more than paper, plastic, aluminum, and glass combined.

5. Russia — 71 Million Tonnes

Russia’s steel industry is among the largest in the world, ranked as the fifth-largest producer and heavily integrated with mining. The industry produced 71 million tonnes in 2024 and employs over 600,000 people. The sector contributes nearly 5% to the country's GDP and 10% of export revenues, making it a vital part of the economy. However, recent sanctions related to the situation in Ukraine have led to a negative trend in steel production and exports. According to the government, sanctions have affected the export of 3.9 million tonnes of finished steel products.

Russia’s steel industry is dominated by major producers such as NLMK, Severstal, MMK, and Evraz, which together account for most of the country's output. The country benefits from large domestic reserves of iron ore and coking coal, allowing vertically integrated production with limited reliance on imports. The majority of steel produced is used domestically in construction, energy infrastructure, pipelines, and rail projects. Since sanctions reduced access to European markets, exports have increasingly shifted toward Asia, the Middle East, and CIS countries, partially offsetting the decline.

6. South Korea — 63.6 Million Tonnes

South Korea is the sixth-largest producer of crude steel with a total production of 63.6 million tonnes as of 2024. The country has been a major player in the global steel industry since the 2010s, when it ramped up production to over 60 million tonnes, a level it has maintained since. The industry has also grown proportionately with the economy, marking around 1.5 to 2.2% of national GDP and over 4% of national exports since 1995. To support the sector, the government launched a 400 billion won export guarantee program and is investing in hydrogen-based steelmaking to drive a transition toward low-carbon, high-value steel production.

South Korea’s steel industry is led by POSCO, one of the world’s most efficient steel producers and a global leader in advanced steel technology. POSCO specializes in high-value products, including automotive-grade steel, shipbuilding plates, electrical steel, and high-strength alloys used in construction and energy infrastructure. The company has been a pioneer in hydrogen-based steelmaking, positioning South Korea at the forefront of low-carbon steel production.

7. Germany — 37.2 Million Tonnes

In 2024, Germany produced 37.2 million tonnes of crude steel, making it the world’s seventh-largest steel producer. According to World Steel and GMK Center data, output rose by about 5.2% compared to 2023, indicating a modest recovery after several years of subdued production. The steel industry directly employs around 80,000 people and supports roughly four million jobs indirectly across manufacturing, logistics, and engineering sectors. Domestically, German steel is primarily used by the automotive and construction industries. In contrast, iron and steel exports totaled approximately US$29.76 billion in 2024, underscoring the sector’s continued importance to the national economy.

The transition toward low-carbon production increasingly shapes Germany’s steel industry. Major producers such as thyssenkrupp Steel and Salzgitter AG are investing heavily in hydrogen-based steelmaking, with government-backed funding aimed at reducing emissions from traditional blast furnaces. At the same time, high energy costs have limited output growth, keeping production below 40 million tonnes for a third consecutive year.

8. Turkey — 36.9 Million Tonnes

The Middle Eastern country of Turkey, or Türkiye, is one of the world's strongest steel producers. The country produced 36.9 million tonnes in 2024, ranking it eighth globally. This production is possible due to a massive electric arc furnace (EAF) infrastructure and heavy scrap metal imports. Most of the country’s steel is produced via efficient recycling in EAFs, enabling a system with over two dozen mills and furnaces. Over half of the country’s steel production is used domestically, in industries such as construction and machinery. Meanwhile, Turkey exported steel to over 190 countries in 2024, totaling 15.5 million tonnes, an uptick from 2023.

Numbers are expected to rise through 2025 and 2026, with Turkey seeing increased production throughout the year. Imports have declined by more than 15% in December 2025, and the TÇÜD Secretary General, Veysel Yayan, said the steel sector is operating at only 61% of capacity, expecting total production to exceed 40 million tonnes in 2026. Much of Turkey’s steel production is concentrated in major industrial regions such as Marmara, Iskenderun, and the Black Sea coast, where proximity to ports supports both scrap imports and export-oriented steelmaking.

9. Brazil — 33.8 Million Tonnes

Brazil produced 33.8 million tonnes of crude steel in 2024, ranking ninth globally and making it the largest steel producer in Latin America. The country has an installed steelmaking capacity of roughly 50 million tonnes per year, meaning output currently operates well below full capacity. Steel production is concentrated in key industrial regions, particularly around Volta Redonda in Rio de Janeiro state, which developed into Brazil’s main steel hub following the establishment of a state-owned steel plant in 1941. Today, the city remains central to the country’s steel industry and supports a fully integrated production chain from iron ore mining to finished steel products.

Brazil’s steel sector benefits from strong domestic iron ore resources, integrated port infrastructure, and proximity to major consumer markets. Major producers include Gerdau, ArcelorMittal, Ternium, and Aperam, supplying steel for automotive manufacturing, construction, and infrastructure projects. However, the industry faces growing pressure from low-priced imports, particularly from Asia. In 2024, steel imports reached a 15-year high of 6.4 million tonnes, prompting Brazilian producers to increase exports to more profitable overseas markets amid strong competition at home.

10. Iran — 31.4 Million Tonnes

Iran ranks tenth among the most steel-producing countries in the world, with a total output of 31.4 million tonnes in 2024. The country’s steel industry is among the most robust in the world, with a focus on hot-rolled coil (HRC) production and large domestic iron ore reserves to support supply. It is also among the most challenging steel industries globally due to regular power cuts in the country, which have led to reliance on non-state power solutions and alternative energy sources to meet demand.

Iran’s modern steel industry expanded rapidly from the early 2000s, driven by infrastructure demand and a push for industrial self-sufficiency. In 2024, the sector received a boost from a domestically developed third-generation Direct Reduced Iron (DRI) catalyst, now used across 30 steel plants. The technology improves efficiency, reduces energy use, and cuts reliance on imports. Developed by an Iranian firm founded in 2004, the catalysts have saved over $400 million in foreign exchange and are also exported to several regional markets.

The Top Steel-Producing Countries In The World

These ten countries are the world's largest steel producers, supporting massive and growing demand. China leads the global market with a production of over 1,000 million tonnes, which is more than that of the other nine combined. However, other countries, such as India and Turkey, aim to increase steel production through advanced technologies and large exports. All in all, this article shows the vast industry spread across the planet and the many people it supports.

| Rank | Country | Production (million tonnes) |

|---|---|---|

| 1 | China | 1,005 |

| 2 | India | 149 |

| 3 | Japan | 84 |

| 4 | United States | 80 |

| 5 | Russia | 71 |

| 6 | South Korea | 64 |

| 7 | Germany | 37 |

| 8 | Turkey | 37 |

| 9 | Brazil | 34 |

| 10 | Iran | 31 |

| 11 | Vietnam | 22 |

| 12 | Italy | 20 |

| 13 | Taiwan | 19 |

| 14 | Indonesia | 18 |

| 15 | Mexico | 14 |

| 16 | Canada | 12 |

| 17 | Spain | 12 |

| 18 | France | 11 |

| 19 | Egypt | 11 |

| 20 | Saudi Arabia | 10 |

| 21 | Malaysia | 9 |

| 22 | Ukraine | 8 |

| 23 | Belgium | 7 |

| 24 | Austria | 7 |

| 25 | Poland | 7 |

| 26 | Netherlands | 6 |

| 27 | Thailand | 5 |

| 28 | South Africa | 5 |

| 29 | Australia | 5 |

| 30 | Algeria | 5 |

| 31 | Bangladesh | 5 |

| 32 | Kazakhstan | 4 |

| 33 | Pakistan | 4 |

| 34 | Sweden | 4 |

| 35 | United Kingdom | 4 |

| 36 | Slovakia | 4 |

| 37 | Argentina | 3.9 |

| 38 | United Arab Emirates | 3.7 |

| 39 | Finland | 3.7 |

| 40 | Oman | 3 |

| 41 | Iraq | 3 |

| 42 | Czechia | 2.5 |

| 43 | Belarus | 2.3 |

| 44 | Portugal | 1.9 |

| 45 | Philippines | 1.9 |

| 46 | Luxembourg | 1.8 |

| 47 | Peru | 1.6 |

| 48 | Kenya | 1.6 |

| 49 | Morocco | 1.4 |

| 50 | Serbia | 1.4 |