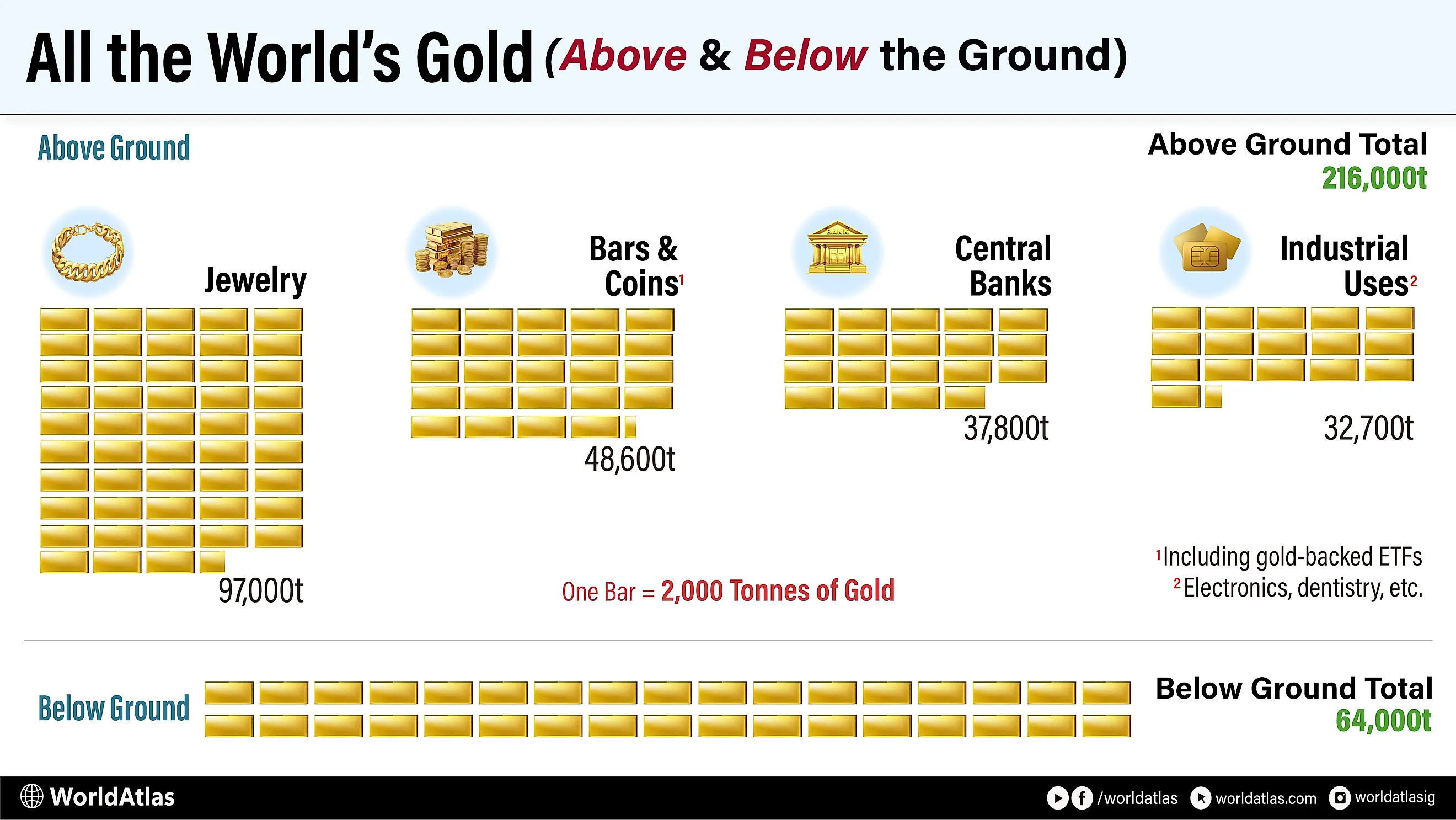

The World’s Entire Gold Supply, Above and Below Ground

Gold's story is a story of scale, durability, and trust that spans temples, trade routes, and vaults.

The World Gold Council estimates that by the end of 2024, about 216,265 tonnes of gold had been mined and remained above ground. About 97,149 tonnes is held as jewellery (around 45%), roughly 48,634 tonnes as bars, coins and gold-backed ETFs (around 22%), and about 37,755 tonnes in central banks and other official reserves (around 17%). Another 32,727 tonnes (around 15%) is embedded in industrial, medical, dental, and decorative uses.

Gold became a shared global language of value because it is scarce, long-lasting, and easy to verify and reshape. Early standardised coinage helped widen trade. Later, the classical gold standard and the Bretton Woods system reinforced the idea that state credibility and financial stability could be anchored to gold.

What remains underground is smaller than many assume. End-2024 estimates place remaining mineable reserves near 54,770 tonnes in World Gold Council reporting, while the USGS often cites about 64,000 tonnes. The stock already in human hands, therefore, dominates the supply story.

In an era of inflation shocks, geopolitical strain, and shifting global confidence in currencies, that imbalance helps explain why gold's reputation still carries power.

Gold Above Ground - 216,000 tonnes

Jewellery - 97,000 tonnes

Around 97,149 tonnes of the world's above-ground gold is held as jewellery, roughly 45% of the total. Jewellery holds more gold than central banks. Gold is durable, so almost all the metal ever mined still exists in some form, making this jewellery pool a major store of recyclable wealth.

Gold's early popularity in adornment came from practical beauty. It is malleable and ductile, allowing detailed work with tools, and it does not tarnish or corrode, so finished pieces can outlast dynasties. These traits supported sacred and cultural uses across early civilisations, while trade routes such as the Silk Roads spread techniques, tastes, and supply.

The modern global market was accelerated by a surge in mine output after 1950, driven by advances in mining technology and new deposits.

Cultural anchors still shape today's demand. In India, weddings and festivals remain the most important drivers of gold jewellery buying, and bridal jewellery accounts for a large share of the market. That mix of emotion and financial prudence explains gold jewellery's global influence: it is wearable art, intergenerational wealth, and a resource that can return to the market when circumstances change.

Bars, Coins and Gold-Backed ETFs - 48,600 tonnes

Bars, coins and gold-backed ETFs account for roughly 48,634 tonnes of the world's gold above ground, about 22% of the total. Gold's popularity as portable wealth began with standardised coinage. Evidence points to Lydia in western Anatolia producing early electrum coins in the second half of the 7th century BCE. This innovation reduced the need to weigh metal for everyday trade and helped gold circulate across major commercial networks.

In the late 19th century, the classical gold standard (1870s-1914) encouraged states and banks to hold gold to support currency stability and international settlement. The Bretton Woods agreement of 1944 renewed gold's official role by fixing the U.S. dollar to gold at $35 per ounce, a link severed in 1971.

Modern products widened access. The South African Krugerrand, first minted in 1967, helped normalise private bullion ownership. A major leap in convenience came with gold-backed ETFs, which offered exposure to vaulted bullion with stock-like liquidity.

These holdings keep gold central to modern finance: easy to trade, hard to dilute, and trusted when uncertainty rises.

Central Banks/Official Reserves - 37,800 tonnes

Central banks and other official institutions hold roughly 37,755 tonnes of gold, around 17% of above-ground stock. This concentration of metal in public vaults gives central banks lasting influence over gold sentiment.

Gold became a key reserve asset because it once anchored currencies and international payments. The classical gold standard and the Bretton Woods framework made gold central to global monetary credibility. Since 1971, gold has served less as formal backing and more as strategic insurance, prized for its liquidity and independence from any single issuer's promise to pay.

Other (Industrial and Decorative) - 32,700 tonnes

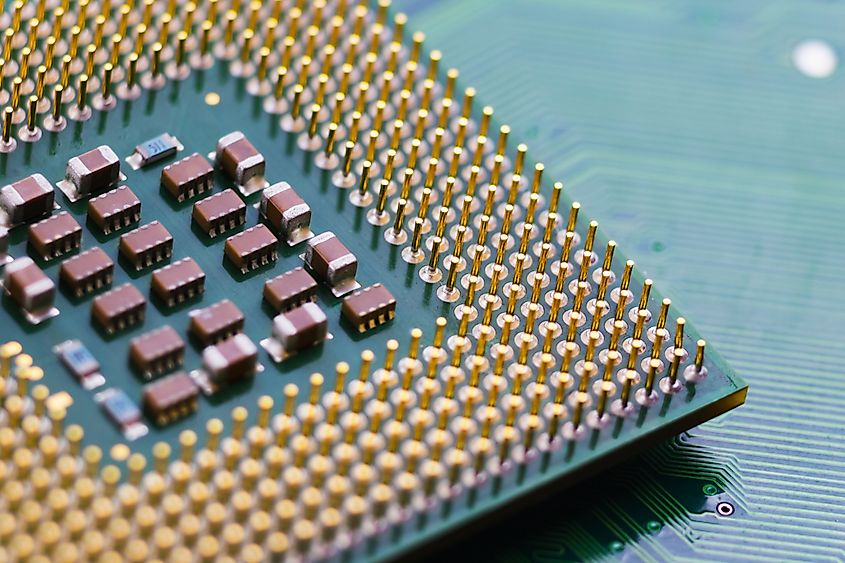

About 32,727 tonnes is grouped as "Other," covering gold embedded in industrial, dental, medical and decorative forms. Decorative applications reach back to ancient gold leaf traditions. Industrial demand reflects gold's reliable conductivity and resistance to corrosion, especially in high-value electronics and specialised components.

Taken together, this stock is a reminder that gold's influence is not only symbolic or financial. It is also quietly structural.

Gold Below Ground - 64,000 tonnes

Gold mining still has a long runway, but the remaining easy-to-count supply is smaller than the above-ground stock. The USGS puts global gold reserves at about 64,000 tonnes, while the World Gold Council gives a slightly lower end-2024 estimate of roughly 54,770 tonnes, reflecting different methodologies and reporting updates.

Standardised coinage, the gold standard, and Bretton Woods transformed gold into a global benchmark of trust. Today, the dominance of above-ground stocks means new discoveries rarely rewrite the supply story overnight, but they still shape national strategy, investment, and long-term confidence.