Worst Countries For Accessibility To Credit Information

Importance of Credit in the Economy

Some economists argue that credit is the foundation for a growing economy. People and businesses borrow money either from private banks or government funds and promise to repay it in the future with interest. Available credit allows for increased spending which propels economic growth. It has a bit of a domino effect as, when spending increases income increases, and when that happens the gross domestic product (GDP) grows. An boost to the GDP adds to productivity.

As the demand for credit within a country rises, banks benefit because they collect income from interest. But how do banks know who to trust with loans? They do so by accessing credit information before making such decisions.

Importance of Accessibility to Credit Information

Credit information provides potential lenders with the necessary data regarding a potential borrower’s ability to repay debt. Banks need this information to approve or decline loan applications. The availability of credit reporting, or credit scores, prompts economic growth by increasing access to loans. Credit information allows for improved consumer and provider relationships that are based on transparent transactions. When lenders are able to make informed and efficient decisions in regard to loan approvals, the risk of financial crisis can be averted.

When access to credit information is unavailable, both proffering and obtaining credit resources becomes costly and inefficient. Some countries have not yet developed a credit reporting system. Below is a look at the countries with the worst access to credit information in the world.

Countries with Poor Accessibility to Credit Information

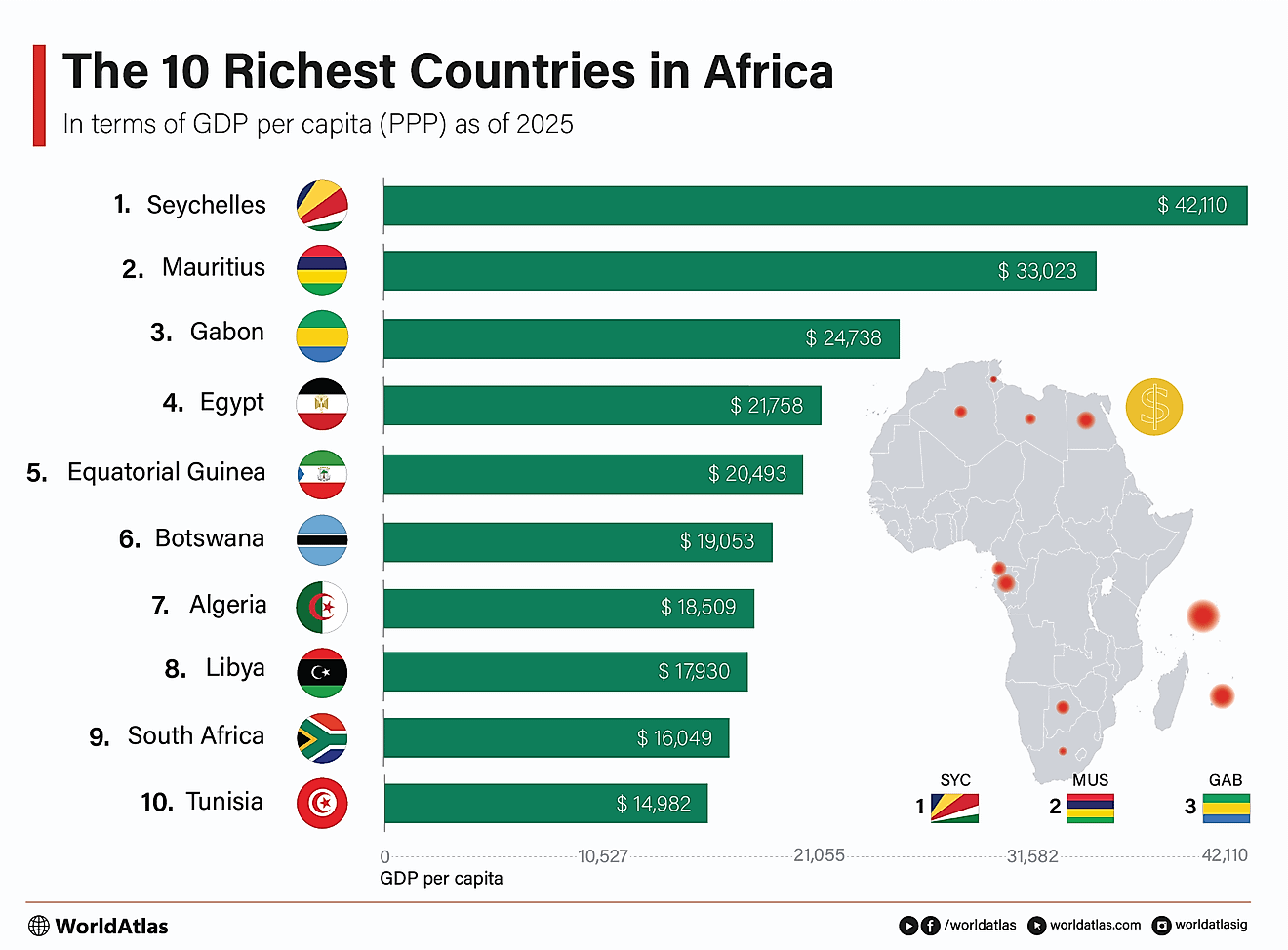

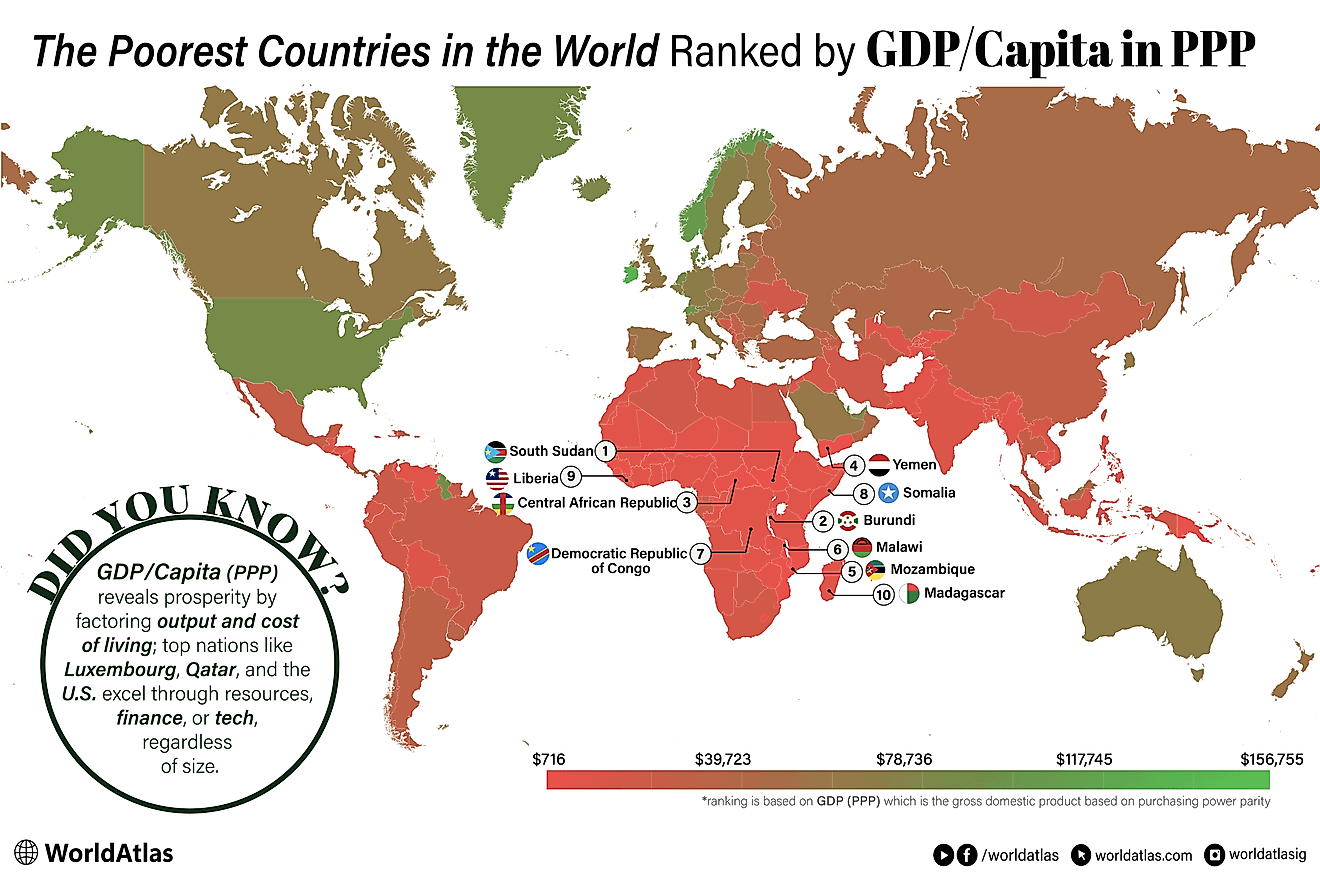

The countries with the worst access to credit information are all located in the developing world, with the majority being in Sub-Saharan Africa. The World Bank ranks this issue on a scale of 0 to 8 based on a list of 8 yes or no questions. A 0 score represents the worst accessibility.

Cameroon is at the bottom of the list with a Depth of Credit Information score of 1. This point has been awarded because the country does distribute information on companies and individuals via a credit registry, not a credit bureau. Following is Equatorial Guinea, Gabon, Mauritania, Republic of the Congo, Syria, and Comoros each with a 2 rating. Tonga and Pakistan have been given a 3. The highest rating, a 4, goes to East Timor.

Negative Consequences and Alternative Credit Sources

When individuals have a difficult time obtaining credit they are unable to expand their small businesses. Faced with this situation, many people turn to informal methods of obtaining money. Informal methods involve unlicensed lenders and group saving activities, to name a few.

Groups of individuals may join together to form their own lending associations. When using this method, each person contributes a pre-agreed upon amount of money on a consistent basis. That money is pooled together and given to a different member of the group each time. For example, 10 people contribute $2 each, therefore, $20 is paid to one of the members. In this way, each person receives a guaranteed sum of money consistently. The disadvantage to this is that the sum received is likely very small and acts more as a savings account than a loan.

More probable, and more detrimental still, is that an individual who cannot access a loan because the bank does not have reliable credit information will turn to an informal money lender instead. These money lenders practice usury, lending money at unethically high interest rates. This practice unfairly benefits the lender and has negative consequences for the borrower, often leaving them unable to pay and further entrenched in the cycle of poverty.

Worst Countries For Accessibility To Credit Information

| Rank | Country | World Bank Depth of Credit Information Score (0=Worst; 8=Best) |

|---|---|---|

| 1 | Cameroon | 1 |

| 2 | Equatorial Guinea | 2 |

| 3 | Gabon | 2 |

| 4 | Mauritania | 2 |

| 5 | Republic of the Congo | 2 |

| 6 | Syria | 2 |

| 7 | Comoros | 2 |

| 8 | Tonga | 3 |

| 9 | Pakistan | 3 |

| 10 | East Timor | 4 |