Largest Recent Reductions And Forgiveness Of International Debts

Mexico

In total, Mexico has received the biggest debt forgiveness of any country at $7.48 billion. Mexico, with other Latin American countries, suffered a debt crisis during the 1980’s that left the country unable to pay foreign loans. This marked the beginning of their debt forgiveness. In the late 90’s, debt reduction resulted in an overall interest reduction that helped stabilize prices and prompt small economic growth.

Brazil

Similar to Mexico, Brazil suffered during the debt crisis of the 1980’s. Being unable to pay back their foreign loans, Brazil applied for debt reduction. This has totaled $580 million. In order to have this debt forgiven, the country had to agree to neo-liberal economic policies which encouraged privatization and decreased government spending. Some economists have argued that this had a detrimental effect on economic growth and essentially led to increased poverty.

Peru

Peru has a similar debt story to those of Mexico and Brazil. During the 1980’s, the country was in deep debt due to inflated interest rates and the global oil crisis. The country applied for debt forgiveness to the World Bank (the holder of most its loans) in the 90’s and while some was forgiven, the majority was rescheduled. This had a significant impact on the economy and by the end of the 90’s, Peru was able to meet its debt payments. Today, it is considered a creditworthy economy. A total of $494 million has been forgiven.

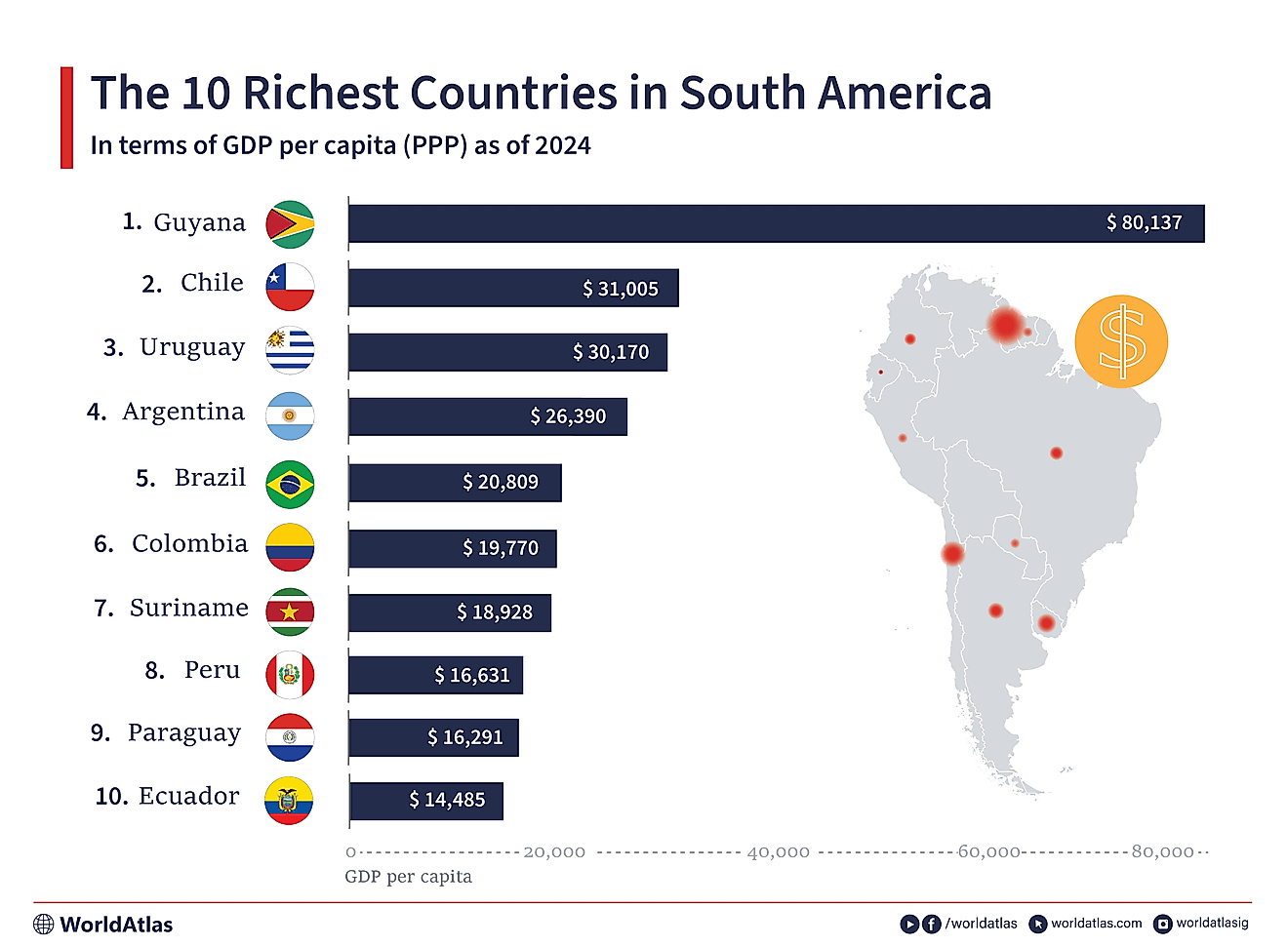

Guyana

Alongside many of its fellow Latin American countries, Guyana also saw uncontrollable debt in the 80’s and 90’s. The economy was in such a crisis during that time that the government began borrowing loans to buy imports. The late 90’s brought a structural readjustment program and some debt relief. The country has received $156 million in debt forgiveness.

Montenegro

This country is the first on the list that is not in Latin America. Montenegro, a European country, has had $111 million forgiven through 2014. Despite this forgiveness, the country has a high debt level today and owes nearly 70% of its GDP. Most of this is for the issue of Eurobonds, debt to the International Bank for Reconstruction and Development, Credit Suisse, and the European Investment Bank.

Jamaica

Jamaica has the world’s third highest debt to gross domestic product (GDP) ratio, which stands at 140%, and is a country rife with stark poverty. As with many developing countries, its debt began accruing in the 1970’s only to reach crisis during the 80’s. Although severely indebted, the country has thus far only had $54 million forgiven. The IMF, World Bank, and IDB are all in discussions now to possibly reduce the debt further.

Uganda

The first African country on the list, Uganda has received $14.7 million in debt reductions. Unlike the other countries mentioned, African nations did not begin to accrue debt until the late 80’s. By the mid 90’s, most countries owed more money than they could produce in goods annually. The monies were not from private lenders but rather other nations and multilateral organizations. Debt forgiveness here took place in the early 2000’s and was a joint collaboration among the World Bank, IMF, African Development Bank, and foreign governments.

Kenya

Kenya has a similar debt history as Uganda, and has received $11.6 million in forgiveness. The country had borrowed significant amounts of money in order to invest in infrastructure projects which was believed would nudge the economy into growth. Instead, the nation faced corruption and bad policies that made repayment nearly impossible.

Malawi

Malawi is the final African country to make this list with $10.3 million in debt forgiveness. Similar to Uganda and Kenya, debt accrual did not have the anticipated economic effect and Malawi was also relieved of a great chunk of loans. But did this help these countries. Some economists believe so. The governments here became the subject of interest for those organizations and countries that were relieving the debt and therefore their policies and budgets came under heavy scrutiny. With that pressure, African countries began to invest extra federal money into public programs such as healthcare and education. This debt forgiveness also allowed them to invest money into natural resources extraction infrastructure. For the most part, the countries have avoided taking on unmanageable debt again although it is now available in the form of private lending.

Honduras

The final country on the list is Honduras, which has seen a total of $5.4 million in debt forgiveness through 2014. In 2015, the International Monetary Fund (IMF) approved a 100% debt forgiveness for any IMF debt the country accrued prior to 2005, which will equal roughly $154 million. This has been enacted under the Heavily Indebted Poor Countries Initiative. Honduras was approved because it has made significant progress in reducing poverty and improving public budget management.

Countries Receiving The Most Reduction And Forgiveness In Debts

| Rank | Country | Net Debt Forgiveness and Reduction Through 2014 |

|---|---|---|

| 1 | Mexico | $7.48 Billion |

| 2 | Brazil | $580 Million |

| 3 | Peru | $494 Million |

| 4 | Guyana | $156 Million |

| 5 | Montenegro | $111 Million |

| 6 | Jamaica | $54 Million |

| 7 | Uganda | $14.7 Million |

| 8 | Kenya | $11.6 Million |

| 9 | Malawi | $10.3 Million |

| 10 | Honduras | $5.4 Million |