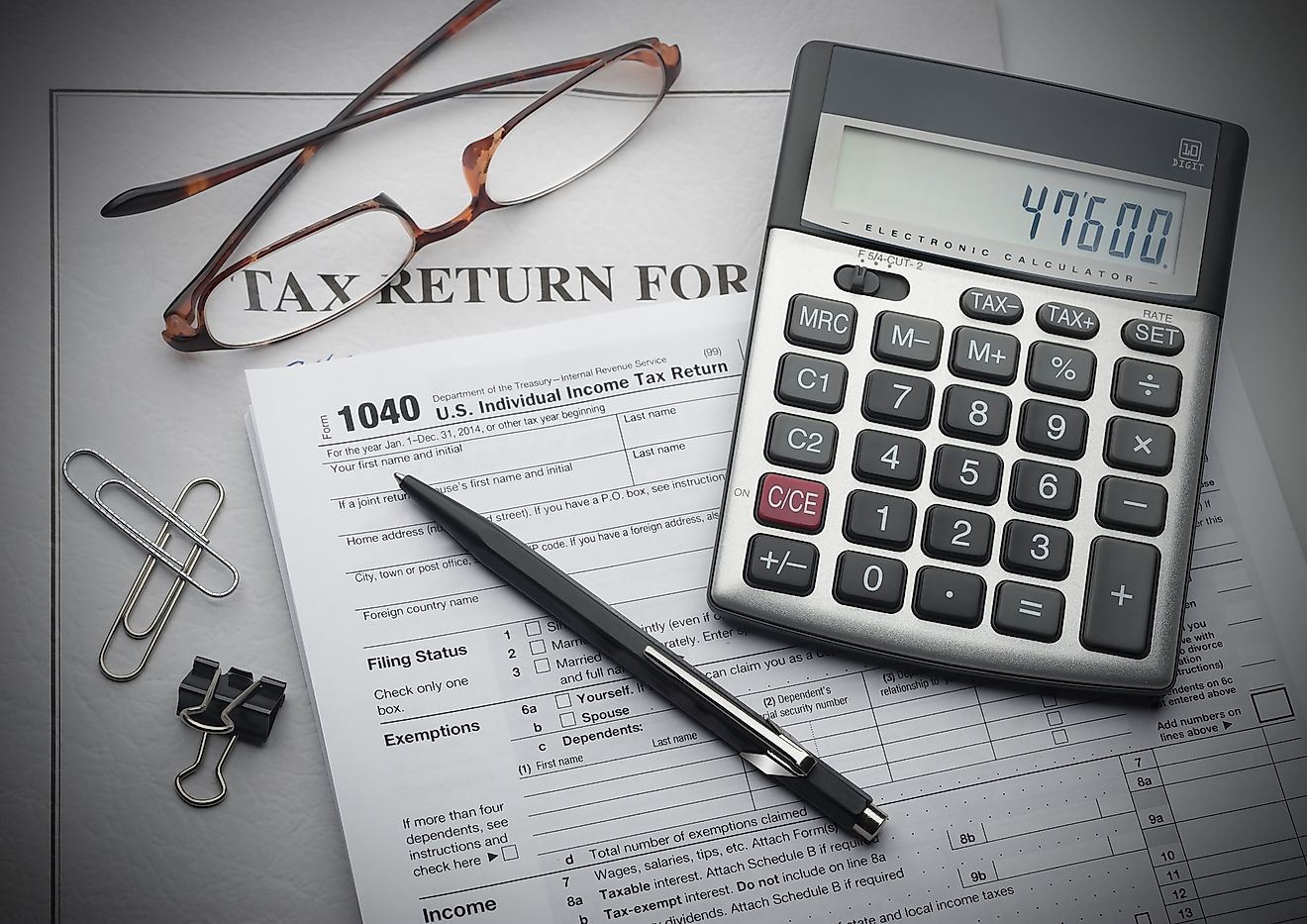

What Percentage Of Americans Don't Pay Income Tax?

- About 80% of people aged 75 and older in the US do not pay income tax because they earn little money.

- Lower income families and individuals that work and receive child benefits can end up owing no tax.

- Among those who receive government benefits, only about 12% will continue doing so after ten years.

Income tax is money that you pay to the government based on what you earn. Tax dollars can go towards paying for many things including government workers’ salaries and vital common resources such as police departments, libraries, parks, roads and fire departments, depending on where you live.

It is true that not all Americans pay taxes, however. According to the New York Times, even President Donald Trump has admitted to not paying income tax for several years. He did this by reporting a $916 million loss on his 1995 income tax returns, which enabled him to avoid paying personal federal income taxes for a length of time.

Who else is not paying? According to Forbes.com, up to 47% of Americans are not paying taxes. That may sound like a lot of people. This percentage is a calculation made by the Tax Policy Center back in 2009. According to Forbes.com summarizing information from Tax Notes.com, this percentage is not as shocking as it may look at face value, once you get into the details of who is not paying.

The Elderly And Working Americans

According to the sources cited about, in reality, only 11% of people aged 25-55 did not pay federal income tax in 2019. Those who do not pay income tax generally fall into two categories: those who are so old they are no longer working, and those individuals who are too young to work, such as children.

Forbes states that more than 80% of people aged 75 and older in the US are not paying taxes, mostly because they are not earning enough to pay. It is likely that a large portion of this group did pay taxes in their younger, working years, however.

In addition to the elderly, there are working individuals and families who still earn too little money to owe the government any taxes at the end of the fiscal year.

Forbes points out that many women may work fulltime and pay taxes until they have a child. After this, if they are working part-time and receiving a child tax benefit, and possibly an earned income tax credit, their taxes could be reduced to zero. In some cases, the government actually owes these families more money, at the end of the day.

Those Who Do Not Pay

Thankfully for the economic health of the country, there are few people of working age who simply do not pay their taxes. Among the individuals who skip paying their taxes for one reason or another, according to Tax Notes.com, about one third will do this for one year. Almost 60% will start paying income tax in the coming three years, leaving just 12.5% as people as rebels who do not pay taxes for ten years or more.

Interestingly, among those who do receive government benefits, about 12% will still be getting these benefits after ten years, Forbes states. The rest have moved onto employment.

Other Taxes

Of course, no one in America evades all taxation, completely. Anyone who purchases an item at a store will pay sales tax. Those who are working and on a payroll will have paid payroll tax, and in some cases, state income taxes as well.

In summary, records show that the vast majority of working Americans do pay their taxes, and those individuals who do not are largely elderly Americans, and those earning too little money to owe anything.