Countries With the Highest Sales Tax

Sales tax is the tax paid to the government for sales of certain goods and services. Whenever a company or a service provider offers their merchandise to the consumers, the government in that particular country usually receives a certain specific amount. Sales tax varies from country to another, depending on the percentage the portion or percentage set by the government in that country. Countries with the highest sales tax are as discussed below.

Top Highest Sales Tax by Country

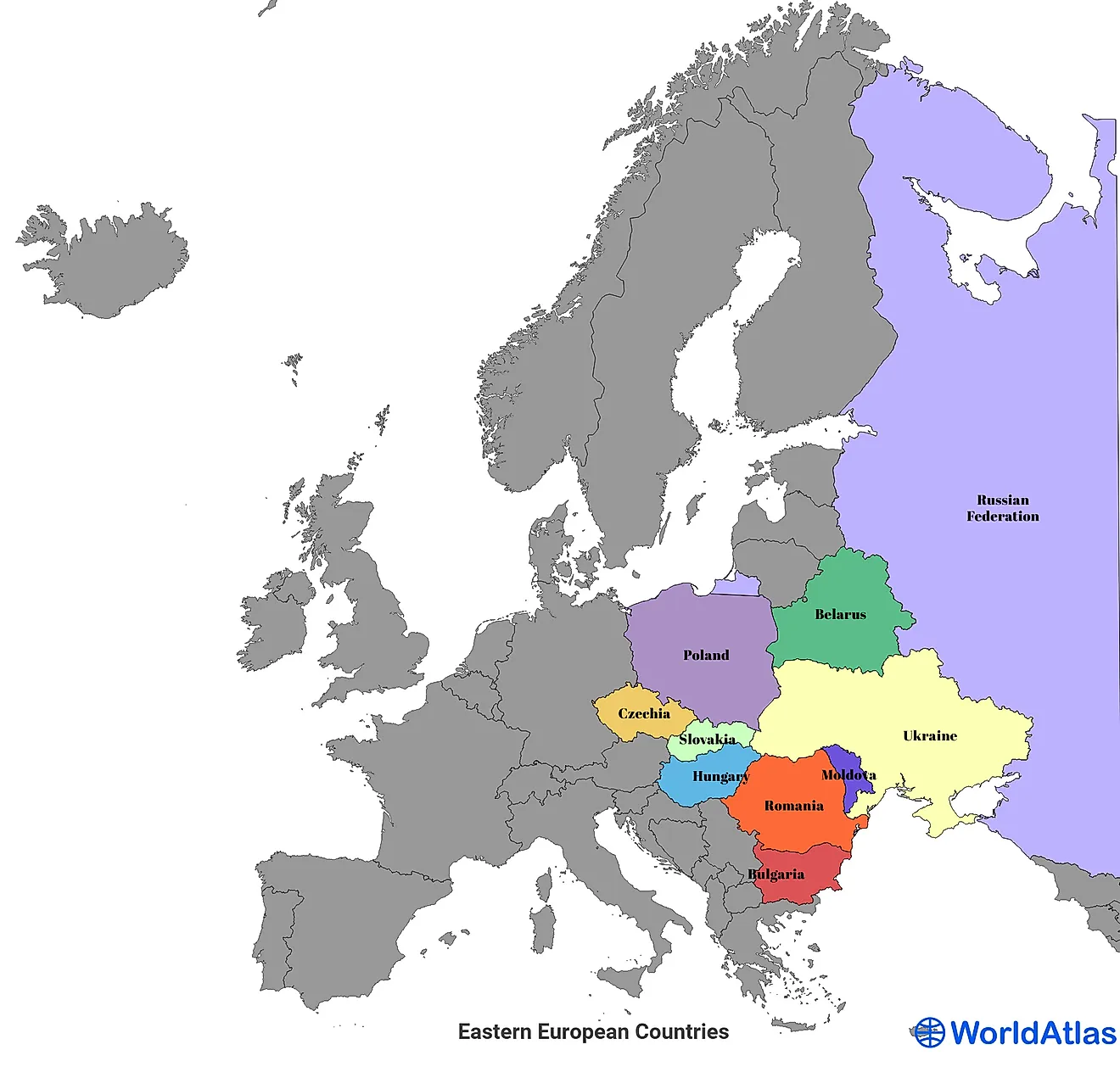

Hungary

Coming in first with the highest sales tax in the world is Hungary. The country’s sales tax stands at 27% of the total sales income. The sales tax was upgraded from 18% as from January 1, 2012. However, there is an exemption on some products such as medicinal products and some food products. Certain food and medicinal products are charged a 22% sales tax. A tax of 18% is imposed on the provision of internet, catering, and baking services. Other forms of tax such as income and corporate tax in Hungary are relatively lower than the sales tax.

Croatia

The government of Croatia imposes a 25% sales tax on the goods sold and services provided in the country. However, some goods are subject to a lower and standardized sales tax. The goods that are subjected to the 13% sales tax instead of the standard 25% include milk, bread, newspapers, books, medicines, and journals. Hotel services are also exempted from the standard tax. Other taxes such as income tax and corporate tax are lower compared to sales tax in Croatia.

Denmark

Denmark imposes a non-deductible sales tax of 25%. There are few goods and services that are exempted from the standard tax of 25%. These include public transportation, foodstuffs, newspapers, travel agencies operations, and rent of certain premises.

Norway

The sales tax in Norway stands at 25%, the standard general rate that is supposed to be applied during the taxation of all the goods and services that are consumed and provided in Norway. However, a few goods such as foodstuffs are subjected to a reduced sales tax of 15%. Services such as public transport and provision of network services in Norway are also subjected to the benefit of a reduced sales tax, which usually stands at 8%.

Sweden

The sales tax subjected to goods and services in Sweden stands at 25%. There is also an exemption for certain specified goods and services. These goods include foodstuffs and medicinal products which are subjected to a 12% sales tax. The services that are exempted from the standard sales tax include public transport and hotel services. Apart from corporate tax, other common forms of tax such as income tax are relatively higher than the sales tax in the sales tax in Sweden.

Effects of High Sales Tax

What are the possible impacts of a government imposing a high sales tax on sales of goods and services? Well, high sales tax keeps off investors. Clearly, investors would prefer countries with low sales tax to those with high sales tax. Low sales tax increases their profit’s margin. Besides, high sale tax that is uniform across all goods and services regressive. By this, it tends to deprive the low-income earners more than the high-income earners. This is because sales rate does not vary depending on a person’s wealth.

Countries With the Highest Sales Tax

| Rank | Country | Sales Tax (Percentage) |

|---|---|---|

| 1 | Hungary | 27 |

| 2 | Croatia | 25 |

| 3 | Denmark | 25 |

| 4 | Norway | 25 |

| 5 | Sweden | 25 |

| 6 | Finland | 24 |

| 7 | Greece | 24 |

| 8 | Iceland | 24 |

| 9 | Ireland | 23 |

| 10 | Poland | 23 |

| 11 | Italy | 22 |

| 12 | Slovenia | 22 |

| 13 | Uruguay | 22 |

| 14 | Argentina | 21 |

| 15 | Belgium | 21 |

| 16 | Czechia | 21 |

| 17 | Latvia | 21 |

| 18 | Lithuania | 21 |

| 19 | Netherlands | 21 |

| 20 | Armenia | 20 |

| 21 | Belarus | 20 |

| 22 | Bulgaria | 20 |

| 23 | Estonia | 20 |

| 24 | Moldova | 20 |

| 25 | Senegal | 20 |