Flags, Symbols & Currency of Zimbabwe

The National Flag of Zimbabwe was officially adopted on April 18, 1980. The flag’s design is based on the official colors of the ZANU PF (Zimbabwe African National Union) and Pan-Africanism.

The National Flag of Zimbabwe features seven equal horizontal bands of green (top), yellow, red, black, red, yellow, and green with a white isosceles triangle edged in black with its base on the hoist side. A yellow Zimbabwe bird is superimposed on a red five-pointed star in the center of the triangle. The green color in the flag represents the agricultural and rural areas of the nation that provide sustenance for Zimbabweans and the country’s rich green cover and fertile lands which makes agriculture one of their most important economic activity. The yellow color stands for the wealth of minerals found in the country, gold is predominant as well as copper, nickel, chromium, and other precious metals. The red color signifies the bloodshed by the people of Zimbabwe while fighting for their freedom from the British colonialists. The black color symbolizes the black heritage of the African people who form the majority of the Zimbabwean population. The white triangle represents the peace that was attained after independence and the return of power to the people. The golden bird which is called the Great Zimbabwe Bird represents the long history of the country and signifies the strong bonds between nature, animals, and the people of Zimbabwe. The bird is found in Zimbabwe and has been a symbol of national unity as far back as 1923. The flag has a width-to-length proportion ratio of 1:2.

History of the Flag of Zimbabwe

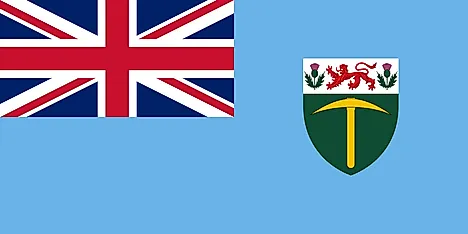

Zimbabwe was under British rule from 1895 to 1980, during this period it was called Southern Rhodesia. The country had different flags which were designed by the British settlers who incorporated most of the British flag colors. The first official flag was made in 1923 for the then Southern Rhodesia which was blue and the Union Jack at the canton side of the flag. It also featured the Southern Rhodesia coat of arms emblem. The flag was used until 1968 when a new flag was adopted which consisted of green-white-green vertical bands with the coat of arms in the middle. This flag again changed in 1979 with the unveiling of a new flag that used the colors red, yellow, black, and green together for the first time. The flag of 1979 lasted for only two months. The country became free after the two Chimurenga wars that led to the death of many Africans and finally culminated in independence. As soon as it gained independence, the country changed its name from Rhodesia to Zimbabwe and adopted the current national flag to signify a new beginning as an independent democratic nation.

Symbols of Zimbabwe

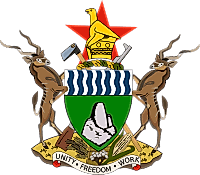

The National Coat of Arms of Zimbabwe

The current official coat of arms was adopted on September 12, 1981. Zimbabwe's coat of arms features two kudus standing on top of a mound composed of wheat, cotton, and maize. The natural colors of the Kudus symbolize the unity of different ethnic groups of the country. The earth mound composed of wheat, cotton, and maize represents the food and clothing of the Zimbabwean people. The kudus support a green shield displaying 14 waves of blue and white with the ancient Kingdom of Great Zimbabwe represented at the base. The green color of the shield represents the fertile soil and the blue-white wavy lines symbolize Victoria Falls and the nation’s prosperity. The Kingdom of Great Zimbabwe represents the historical heritage of the nation. The rifle and hoe placed above the shield symbolize the transition from war to peace. The decorative wreath formed by twisted gold and green silk represents agriculture and mining the backbone of the country’s economy. Transposed from the national flag are the Soapstone Bird and red star in remembrance of the suffering faced by the people and a pledge to avoid any recurrence of that suffering. Below the shield is a white scroll displaying the national motto: “Unity, Freedom, Work”.

National Motto

"Unity, Freedom, Work"

National Anthem

- Anthem Title: "Simudzai Mureza wedu WeZimbabwe" ("O lift high, high, our flag of Zimbabwe")

- Music Composer: Fred Changundega

- Lyricist: Solomon Mutswairo

- Date of Adoption: 1994

"Simudzai Mureza wedu WeZimbabwe" ("O lift high, high, our flag of Zimbabwe") is the official national anthem of Zimbabwe. The music of the anthem have been composed by Fred Changundega. The lyrics of the anthem have been authored by Solomon Mutswairo. The national anthem was officially adopted in March 1994.

"Simudzai Mureza wedu WeZimbabwe" (Shona)

First Verse:

Simudzai mureza wedu weZimbabwe

Yakazvarwa nemoto wechimurenga,

Neropa zhinji ramagamba

Tiidzivirire kumhandu dzose;

Ngaikomborerwe nyika yeZimbabwe.

Second Verse:

Tarisai Zimbabwe nyika yakashongedzwa

Namakomo, nehova, zvinoyeveedza

Mvura ngainaye, minda ipe mbesa

Vashandi vatuswe, ruzhinji rugutswe;

Ngaikomborerwe nyika yeZimbabwe.

Third Verse:

Mwari ropafadzai nyika yeZimbabwe

Nyika yamadzitateguru edu tose;

Kubva Zambezi kusvika Limpopo,

Navatungamiri vave nenduramo;

Ngaikomborerwe nyika yeZimbabwe.

"O lift high, high, our flag of Zimbabwe"

First Verse:

O lift high, high, our flag of Zimbabwe;

Born of the fire of the revolution;

And of the precious blood of our heroes.

Let's defend it against all foes;

Blessed be the land of Zimbabwe.

Second Verse:

Behold Zimbabwe so richly adorned

With mountains and rivers, beautiful.

Let rain abound and fields yield the seed

May all be fed and workers rewarded.

Blessed be the land of Zimbabwe.

Third Verse:

O God, bless the land of Zimbabwe,

The land of our heritage,

From the Zambezi to the Limpopo.

May our leaders be just and exemplary,

Blessed be the land of Zimbabwe.

The Currency of Zimbabwe is the RTGS dollar (Zimdollar)

The currency of Zimbabwe from June 24, 2019-March 2020 was RTGS dollar (Zimdollar). After March 2020, different foreign currencies like the United States dollar, South African Rand, Indian Rupee, Botswana Paula, Australian Dollar, UK pound sterling, Chinese renminbi, and Euro were allowed to be used.

The Reserve Bank of Zimbabwe offered to exchange their dollar for the US dollar at the rate of 1 USD to 35 quadrillion Zimbabwean dollars. The aim was to stabilize the economy by establishing a credible anchor to curb inflation. The return of the Zimbabwean dollar will only take place once major economic fundamentals are addressed.

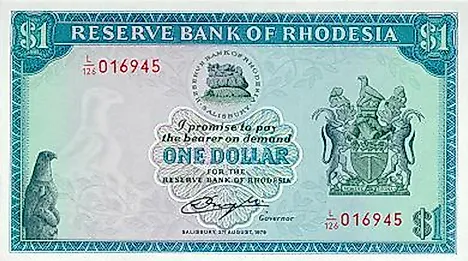

Historical Currencies of Zimbabwe

The Zimbabwean dollar was introduced in 1980 to replace the Rhodesian dollar. The dollar was stable until various omissions and commissions led to it becoming one of the poorest performing currencies in the world. By the early 2000s, Zimbabwe started experiencing hyperinflation. The redenomination of the Zimbabwean dollar has been done thrice. The first redenomination happened in August 2006 despite the economy not recording any growth. The initial dollar was redenominated at the ratio of 1000:1 to the second dollar. When measured against the US Dollar, the new dollar (second Zimbabwean dollar) was devalued at 60%. In July 2008, the second redenomination took place making the currency more worthless. There was a shortage of new currency both in notes and coins. Business people refused to take such currency making the government allow some retailers to accept foreign currency. The foreign currency became widely acceptable in September 2008. The US Dollar and South African Rand began circulating. The rate of inflation kept on rising to force the government to print more banknotes of up to ten zeros. The third redenomination occurred in February 2009. In the new legal tender, 1,000,000,000,000 Zimbabwean dollars were to be exchanged for one new dollar (ZWL). Despite the redenomination, the economy deteriorated further. In January 2009, it was announced that Zimbabweans were free to trade using any currency in addition to the fourth dollar. Later in April 2009, the fourth dollar was suspended and people were free to use any currency. In January 2014, the Central bank announced that currencies of other countries were acceptable. In 2015, the Zimbabwean dollar was demonetized. In 2016, the Zimbabwean bond was introduced. The bond was as per the value of two and five US dollars.