What Does Islamic Economics Mean?

The term Islamic economics is used to refer to Islamic commercial jurisprudence. It is an economic ideology based mainly on the teachings of Islam and takes a middle ground between the system of Marxism and capitalism. The Islamic law, Shari’a, stipulates what is encouraged, prohibited or desired in economic activity. Many scholars have come up with different definitions for the term, but no single definition has been accepted universally. In this article, we discuss the applications and evolution of Islamic economics.

History and Principles of Islamic Economics

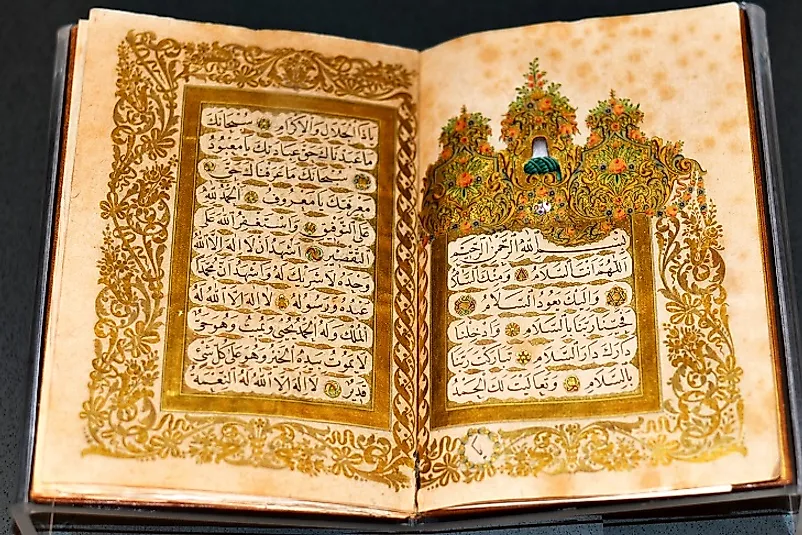

The branch of Islamic economics emanated from a number of traditional Islamic concepts. One of the key concepts included Zakat which referred to the charitable taxing of certain assets. The proceeds from the taxes are channeled to eight expenditures which are expressly mentioned in the Quran. The other concepts include Taa’won (mutual competition) and the doctrine of fairness in all dealing. Qamar (gambling), Riba (interest), and Gharar (high degrees of uncertainty) are highly discouraged in Islam. Islam economics is as old as the Islam religion but was formally recognized in the 20th Century. The Sunni branch of Islam did not see the need to study economics since their predecessors, including the Prophet Muhammad, apparently never took an interest in it. However, the Shi’a Muslims thought that it was important to incorporate the subject in their religion. Some of Shi'a thinkers brought about some very important answers to contemporary economic problems in their books. They include Mahmud Taleqani (author of Our Economics), Abolhassan Banisadir (author of The Economics of Divine Harmony), and Habibullah Perman. These writers depicted Islam a religion that values social Justice and equitable distribution of resources.

Relevant Applications

The field of Islamic economics is widely used today by members of the Muslim community in making financial decisions. For example, Sharia-compliant banks do not charge interest on loans or money deposited in their accounts. The Quran states that all property belongs to God and that is only entrusted by God to take care of the property. According to Islam scholars, property can be divided into three forms, namely being either private property, public property, or state property. He field also advocates for regulation of markets to protect consumers and resolve health issues. Some countries like Pakistan that use the Sharia law to govern have attempted to have a controlled market economy. The Islamic banking institutions have been said to be the only viable and feasible application of the Islamic economics. These banks charge zero interests on loans and deposits. According to Islam, interest is Haram (not allowed).

Evolution Over Time

This field has developed over time to become a way of financial decision making in daily living for those in the Muslim community. It has also become one of the most sought after academic fields. As at 2008, there were over a thousand unique titles about the topic and over 200 people had graduated with Doctorates of Philosophy (PhD.) in Islamic economics. Moe people are showing much interest learning on the topic.

Praises and Criticisms

Economists have argued that most of the concepts in Islamic economics are not practical, and many have even asserted that they are driven by religious fanaticism rather than in trying to solve existing problems. Others have criticized the idea of market controls arguing that it is more efficient to allow market forces to dictate the trend of the market and protect consumers. Proponents of the idea on the other hand have argued that it has led to a more equitable society which protects the less fortunate. However, the principles of the economic model are totally impractical and only wishful thinking.