Countries With The Highest Gross National Savings

Savings typically means the difference between an income and what is spent from it. In reference to Gross National Savings, the meaning is somewhat different. The Gross National Savings is not only the savings of a household, but it involves a particular nation's collective ability to save, including individuals, businesses, and the government. The way we obtain a figure for Gross National Savings is by deducting a nation’s final consumption expenditures from its Gross National Disposable income. When this approach is conducted, the figure will consist of such items as aggregate personal savings and all those monies saved by businesses and governments. Excluded from this total are foreign savings. A representation of the final figure is then represented as a percentage of the Gross Domestic Product (GDP). If a negative number is shown, it can often be a sign of that the economy, as an entirety, is spending more income than it produces. When this happens, dissaving will occur and potentially decrease a country’s national wealth.

Around the globe, many countries manage to save a considerable proportion of their revenues. The countries with the highest gross national savings usually have implemented particular types of economic policies which are conducive to such savings being attainable. It seems the trend is that these savings come from either a ‘crude economy’ or an ‘emerging economy’.

Savings among Crude Economies

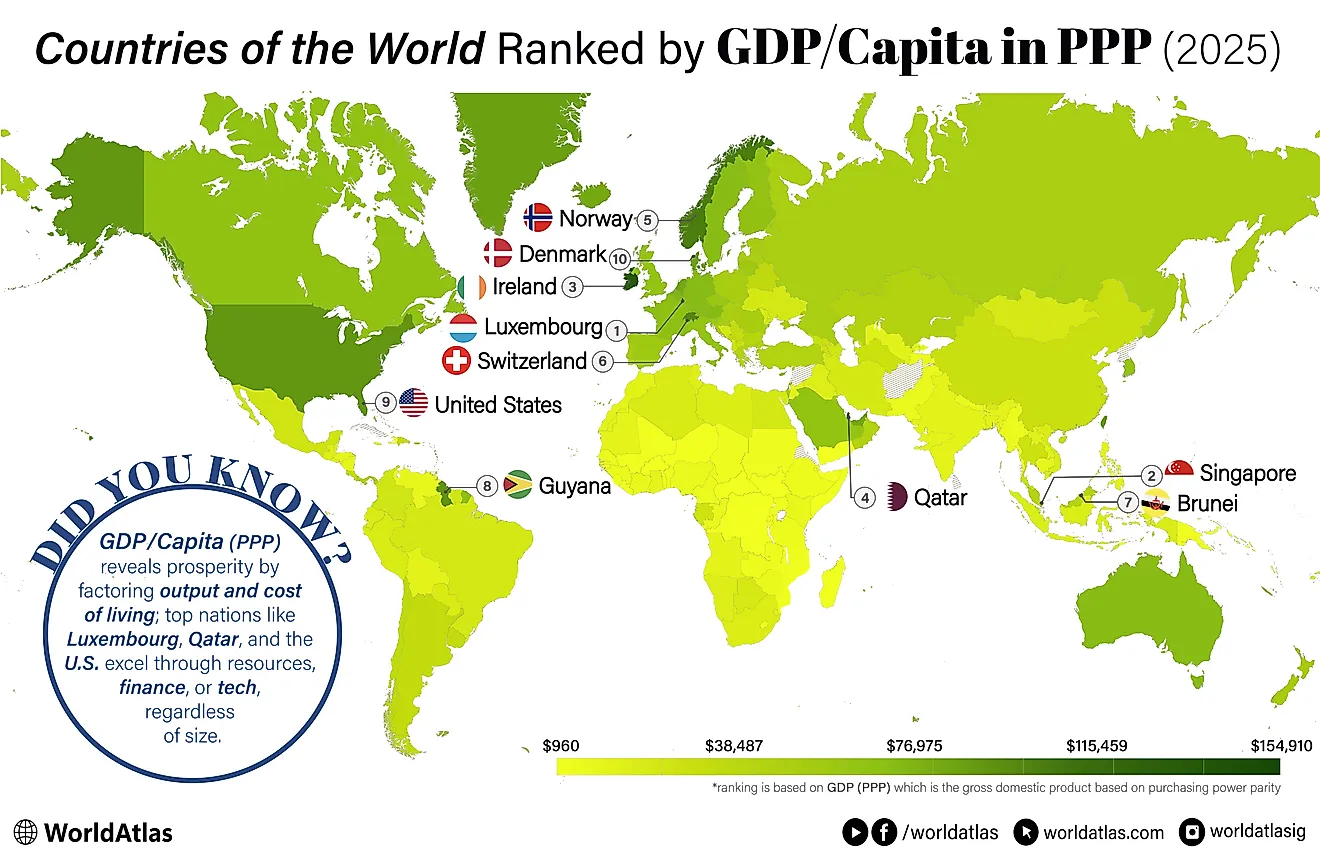

In a 'crude' economy, the country's economic wealth and national savings is primarily derived from the extraction and subsequent processing and sale of fossil fuel resources, such as oil or natural gas. Crude oil is a natural product that can be refined to generate a more useable creation. For example, gasoline and diesel fuel come from these types of resources. It is a nonrenewable resource which means that once it is consumed it can no longer be naturally replaced by the planet within a feasible time frame. Countries such as Kuwait and Qatar in the Middle East rely on these crude resources for their revenues, which contribute to higher relative savings levels. Qatar, for instance, is simultaneously one of the highest gross national savings leaders in the world and holder of the third largest reserves of natural gas.

Savings Among Emerging Economies

Another type of national economy that will often fit into the high relative savings group is that of an ‘emerging’ economy. Typically, a country's desire of moving towards a more progressive society is achieved by emphasizing industrialization and other techniques that foster rapid economic growth. Countries such as Saudi Arabia and China are considered to be moving from an emerging economy to world-leading developed ones. The difference between emerging market economies that many countries are considered to have, as opposed to the more recognized developed markets common to East Asia, North America, and Western Europe, is that they will not typically have a set of strict regulatory standards in place, which may lend to achieving higher savings levels due to lowered regulatory costs. Further, the use of banks and stock exchanges are very much in place in such economies, enhancing their respective abilities to achieve high gross national savings more still.

Accord among the Practices of Top Savers

Countries with the highest gross national savings seem to typically possess two important common aspects: a desire to handle their own finances and readily accessible natural resources. While such practices can be highly advantageous, a common cause for concern is that many natural resources cannot be replaced, and unregulated economies can breed monopolies and corruption. In both instances, we commonly see human and natural resources alike rapidly being depleted, whether they be petroleum, workers’ capacities for production and innovation, or confidence of investment among foreign and domestic venture capitalists.

What Can Be Learned From Global Leaders in Savings?

Nonetheless, it is particularly inspirational to see that many of the countries with the highest savings are relying on themselves and what they can create. Whether they are able to do so by conducting effective finance management or increasing outputs from natural resource processing, many of the world leaders in Gross National Savings set examples that other nations at all stages across the development spectrum could benefit from taking note of. By taking a closer look at their means and methods, other countries may better enable themselves to raise their relative national savings.

Countries With The Highest Gross National Savings (As Percentage Of GDP)

| Rank | Country | Gross National Savings (% of GDP) |

|---|---|---|

| 1 | Macao | 63 |

| 2 | Suriname | 56 |

| 3 | Luxembourg | 54 |

| 4 | Ireland | 53 |

| 5 | Singapore | 51 |

| 6 | Qatar | 51 |

| 7 | Gabon | 46 |

| 8 | Brunei | 43 |

| 9 | Panama | 41 |

| 10 | Algeria | 40 |

| 11 | Thailand | 37 |

| 12 | South Korea | 36 |

| 13 | Indonesia | 35 |

| 14 | Malta | 34 |

| 15 | Czech Republic | 34 |

| 16 | Mongolia | 34 |

| 17 | Malaysia | 33 |

| 18 | Kazakhstan | 32 |

| 19 | Saudi Arabia | 32 |

| 20 | Netherlands | 31 |

| 21 | Norway | 30 |

| 22 | Sweden | 30 |

| 23 | Hungary | 29 |

| 24 | Slovenia | 29 |

| 25 | Vietnam | 29 |