Major International Debt Buyback In The Last Decade

The recent worldwide economic recession had a devastating effect on most countries and private organizations. The effects can still be felt even in the current economies as most companies struggle to get a grip on the economy. Companies are using the tail end of the recession for debt buyback at a substantial discount to the original value thus allowing them to restructure capital to a fair level. Debt buyback can be defined as the process of repurchasing own debt by a debtor at a price lower than the original price thus reducing both interest cost and the outstanding balance. In this case, the debtor’s obligation reduces while the creditor is paid a once for all amount. Debt buyback is becoming unpopular because of the recovery in investor’s confidence and the reduction in the credit crisis. Several countries around the world have bought back debts worth millions of US dollars in the last decade. Some of the major international debt buybacks in the last decade are looked below.

Mexico, 2014, 2013 and 2012

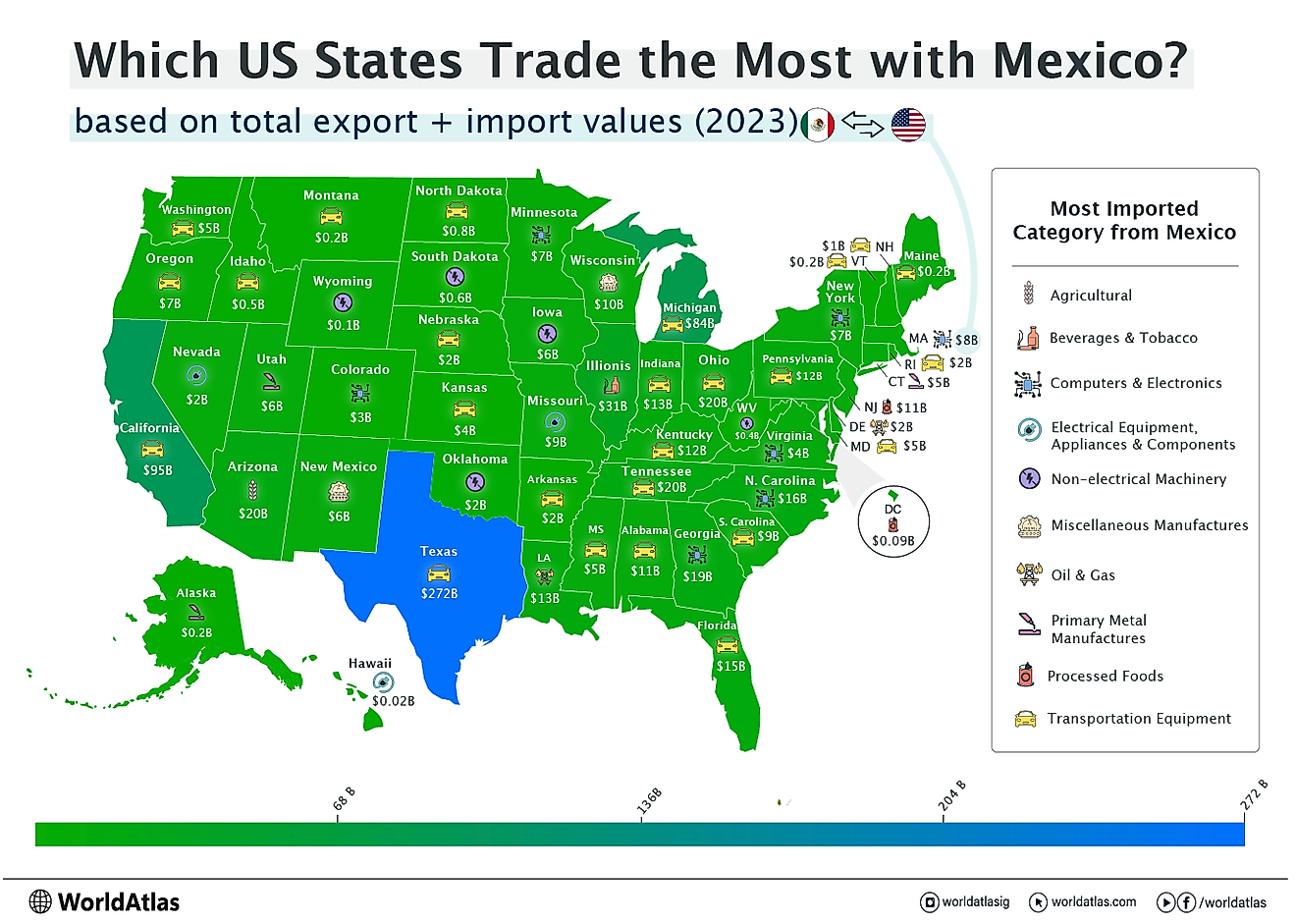

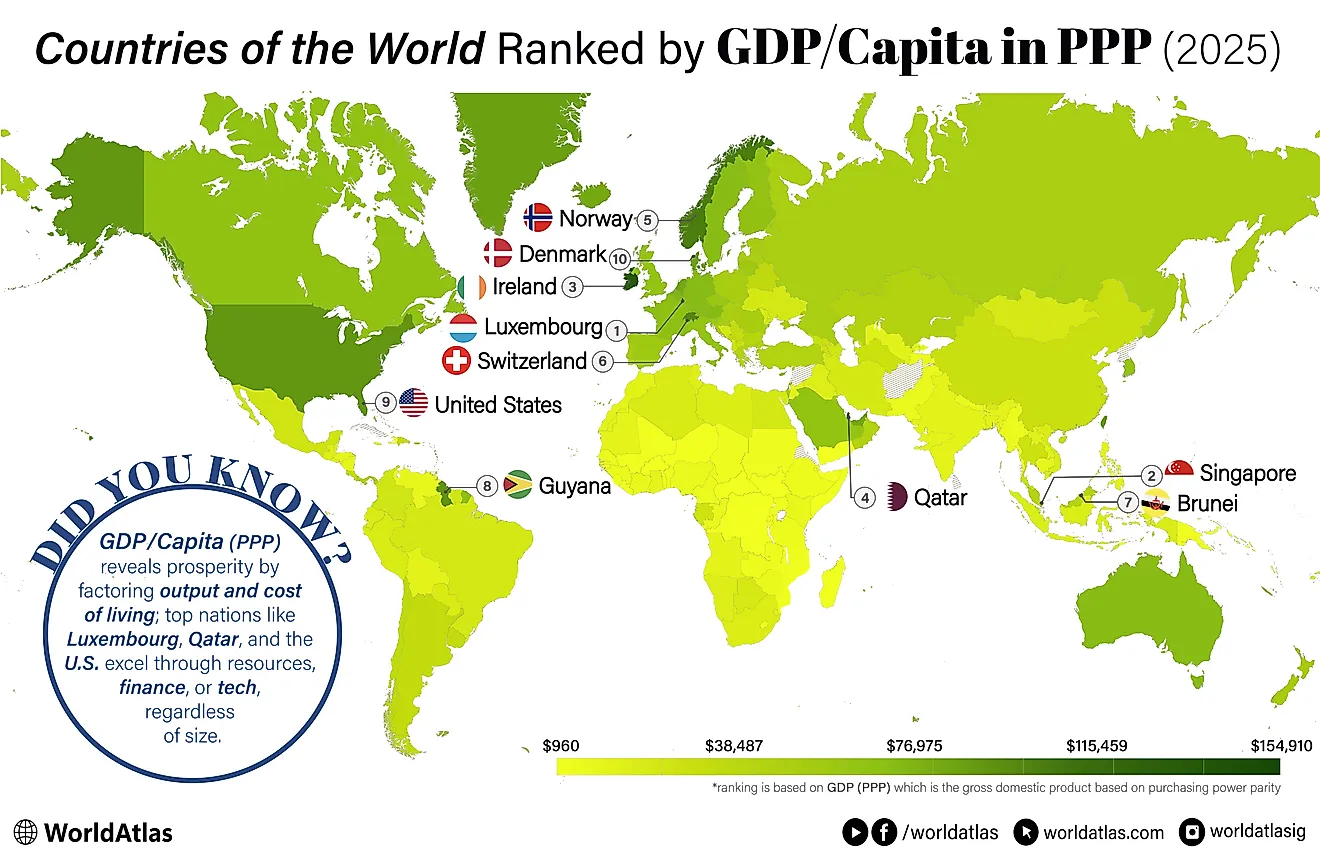

According to World Bank International Debt Statistics, Mexico’s value for debt buyback was US $1.4 billion in 2014, indicating a $2 billion decrease from the previous year. In 2013 the value for Mexico’s debt buyback was $3.05 billion while in 2012 the value was $2.7 billion. Over the last decade, the value has fluctuated with the highest value recorded in 2001 and the lowest value recorded from 2003 to 2009 that is $8 billion and $0 respectively. Mexico took advantage of the declined borrowing cost to sell a bond that was used to pay for the debt buyback. In 2014 the country bought back the Tequila crisis bond that was borrowed in 1996 from the US. In the same year one of Mexico’s major cement producers, Cemex, bought back $950 million from bondholders employing tender offer. In 2013 Mexico bought back the entire Euro bond that was due in 2013, 2015, 2017, and 2020 at a basic point of 135. Mexico has also reduced their borrowing cost by 2% over the last decade while the country also sold bond worth $11 billion in different currencies including Euro, dollar, yen, and pounds. In 2014 the government of Mexico also sold a $2 billion Ten-year bond to finance its debt buyback. Even with the help from the bond market, the country is struggling to attract investors to its local currency market making it a challenge for debt buyback.

Indonesia, 2012

Indonesia’s debt buyback value in 2012 was $230 million, the only debt buyback the country has had since 1989. From 1989 to 2013, Indonesia had not managed any debt buyback neither has the country achieved any after 2012. The 2012 debt buyback was triggered by an enactment of Government Debt Security. In 2012 the government of Indonesia mainly bought back two HSH Nordbank subordinate bonds. The country also bought bonds that were to mature from 2012 through 2016 in 2012.

Caught in the Cycle of Debt

Most of the countries listed have major debts spanning back across the last four decades. The debts continue to hurt the economy by their high-interest-rate and diminishing value. The countries are mainly selling bonds to raise money for debt buyback. Most creditors are reluctantly selling back the debt because it leads to a non-viable business result for them.

Major International Debt Buyback In The Last Decade

| Country, Year | Debt Buyback Amount ($US) |

|---|---|

| Mexico, 2014 | $1,413,442,000 |

| Mexico, 2013 | $3,052,549,000 |

| Indonesia, 2012 | $230,000,000 |

| Mexico, 2012 | $2,564,128,000 |

| Senegal, 2011 | $200,000,000 |

| Mexico, 2011 | $437,198,000 |

| Mexico, 2010 | $1,745,902,000 |

| Peru, 2010 | $496,758,000 |

| Ecuador, 2009 | $2,986,791,000 |

| Bulgaria, 2009 | $122,888,000 |

| Gabon, 2009 | $44,480,000 |

| Liberia, 2009 | $31,962,000 |

| Gabon, 2008 | $2,109,749,000 |

| Jordan, 2008 | $2,037,887,000 |

| Peru, 2008 | $838,346,000 |

| Panama, 2008 | $21,000,000 |

| Bulgaria, 2008 | $2,871,000 |

| Peru, 2007 | $2,343,268,000 |

| South Africa, 2007 | $1,222,445,000 |

| Gabon, 2007 | $436,287,000 |

| Nicaragua, 2007 | $16,537,000 |

| Panama, 2006 | $202,843,000 |