Flags, Symbols, & Currencies of Monaco

The flag of Monaco is exceptional in its design, and is unlike any other national flag in Europe. However, Monaco's flag is similar to Indonesia's, but differs in terms of its dimensions. The two nations have had disagreement in the past regarding the similarity of the two national flags. Monaco refused to recognize the flag of Indonesia after the country adopted it in 1945, with Monaco demanding that Indonesia changed the colors on its flag. Indonesia refused Monaco's request, arguing that its (Indonesia’s) choice of colors was based on the country’s history, which it claimed predated that of the Principality of Monaco. Indonesia adopted the flag despite resistance from Monaco, and its original design stands to date. The flag of the German state of Hesse also bears resemblance to the flag of the Principality of Monaco. Other flags that are similar in design to Monaco's include the flags of Poland, Germany’s state of Thuringia, and Singapore.

The description of the flag of Monaco is explicitly outlined in Title I of the Constitution of the Principality of Monaco. The flag has a horizontal rectangular design with a width-to-length ratio of 4:5. Another legally accepted width-to-length ratio is 2:3. The flag is made up of two horizontal stripes of equal size. The top stripe is red, while the bottom stripe is white. Like many national flags, the colors on Monaco's flag are symbolic. Red and white are the traditional colors of the House of Grimaldi, which established the Principality in 1339. These colors are claimed to represent positive human values, as red is believed to represent the flesh of the human body, while white represents purity in spiritual life.

History of the flag of Monaco

The flag of Monaco is one of the principality's national symbols. The current design of the Principality of Monaco's flag was adopted on April 4th, 1881, during the reign of Prince Charles III. The origin of the design can be traced back to the early 14th century, making it one of the oldest flags in the world. The original flag of Monaco was similar in design to its current flag, but also featured the nation’s coat of arms.

Symbols of Monaco

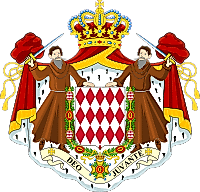

National Coat of Arms of Monaco

Coat of ArmsMonaco's coat of arms is another national symbol, and its origins dates back to the principality's establishment in the 14th century. The coat of arms features two monks bearing swords on one hand and supporting the fusily, argent and gules with the other hand. The emblem is surmounted by the crown of the Prince of Monaco. The two monks with swords represents the 1297 Conquest of Monaco, when Grimaldi, the principality’s founder, led his soldiers to capture Monaco while dressed as monks. The fusily, argent and gules on the shield are composed of red and white diamonds, which represents the House of Grimaldi. Below the Friar's feet a ribbon display's the country motto: Deo Juvante ("With God's help").

National Anthem

- Anthem Title: "Hymne Monégasque" ("Monégasque Anthem")

- Music composer: Léon Jehin

- Lyricist: Louis Notari

- Date of Adoption: 1848

The national anthem of Monaco is known as "Hymne Monégasque" ("Monégasque Anthem"). The anthem's first edition ws written and composed by Théophile Bellando de Castro in 1841. However, the melody was later modified by Castil-Blaze. In 1848, Bellando's song was adopted by the National Guard and became the March of the National Loyalists. In 1931, Louis Notari, pioneer of Monégasque literature, wrote the anthem's lyrics in the Monégasque language. The official anthem of Monaco is in the Monégasque language and not French as many people think.

Hymne Monégasque

Despoei tugiù, sciü d'u nostru paise

Se ride aù ventu, u meme pavayun

Despoei tugiù a curù russa e gianca

E stà l'emblèma d'a nostra libertà

Grandi e piciui, l'an sempre respetà

Amu ch'üna tradiçiun,

Amu ch'üna religiun,

Amu avüu per u nostru unù

I meme Principi tugiù

E ren nun ne scangera

Tantu ch'u suriyu lüjerà;

Diu sempre n'agiüterà

E ren nun ne scangera

Monegasque Anthem

Forever, in our land,

One flag has flown in the wind

Forever, the colours red and white

Have symbolised our liberty

Adults and children have always respected them.

We have perpetuated the same traditions;

We celebrate the same religion;

We have the honour

To have always had the same Princes.

And nothing will change

As long as the sun shines;

God will always help us

And nothing will change.

The Currency of Monaco is the Euro

Monaco is part of the Eurozone ad uses Euro as its official currency. The euro was adopted in 2002 as a replacement of the Monegasque franc, used from 1987.

Coins

The euro is divided into euro cents, with 100 cents as the smallest denomination. Euro coins are available in several denominations, including 1c, 2c, 5c, 10c, 20, 50c, €1, and €2. All the coins have similar features, with the only difference being the denomination.

Banknotes

Euro banknotes have similar designs on both sides and are issued in the denomination of €5, €10, €20, €50, €100, € 200, and €500. However, each note has its color, with each dedicated to an artistic period in the history of European architecture. Other features include gateways or windows on observe and bridges on the reverse side.

Historical Currencies of Monaco

Monaco adopted the euro as its official currency in 2002 as a replacement for the Monegasque franc, which had been used as the legal tender of the country since 1837. Besides Monaco, the franc was also used by France and Andorra. The ISO code of the currency was MCF. One Monegasque franc was divided into 100 subunits known as centimes or ten units called décimes. In 1960, Monaco revised the value of its franc and introduced a new series of francs to replace the old franc at a ratio of 1 new franc to 100 old francs. When the euro was adopted by the country, the conversion rate of the franc to the euro was 6.55957 MCF to 1 EUR.