What Caused The Great Depression?

Many nations suffered from an economic depression in the 1930s which is infamously known as the Great Depression. The downturn commenced in the US, and by the time it was over, it had made history as the longest and most extensive depression of the twentieth century. The period was characterized by a reduction in investments and industrial and consumer spending, and unemployment. The fall of the US economy was significant as the country had arisen as the largest economy after the first World War. It had fashioned itself as a financier of postwar European nations and thus forged close relationships with the countries. The failure of the US economy caused the drying up of investments to Europe. The imbalances and weaknesses of the US economy were greatly exposed during the economic depression. European states, on the other hand, struggled to recover from the results of the war. The economic downturn tainted the presidency of President Herbert Hoover, and the American population warmed up to Franklin Roosevelt whom upon his election in 1932 promised better economic conditions. The depression's causes have been widely pondered by economists, and they are still a concern of active debate.

The Stock Market Crash of 1929

During the 1920s, the New York Stock Exchange attracted many speculators as everyone channeled their money into stocks. The market greatly benefited from these investments, and it subsequently expanded, reaching its climax in August 1929. Stock prices were, however, higher than their real value and unemployment had already risen and production reduced. The stock prices continued to rise even though there was a mild recession in the summer of 1929. A total of 12.9 million shares were traded on October 24, 1929, which was overpriced by investors nervous about a stock market crash. A further 16 million shares were traded on October 29 as panic swept the market exchange yet again. Millions of shares were soon found out to be worthless and investors who had purchased stocks using borrowed money lost completely. Factories were forced to let go of workers and slow down production while wages and buying power reduced. Repossessions and foreclosures rose steadily while those Americans who had been forced to purchase on credit fell into debt. The global observance to the gold standard facilitated the spread of the downturn to other nations.

Bank Failures

More than 9,000 banks failed in the course of the 1930s. Although the Great Depression commenced like for any other recession, the situation had gotten worse in the last half of 1929. People panicked after the stock market crash, and were worried about the safety of their money. The number of bankruptcies rose as the public's confidence reduced and 650 banks failed in the first year of the recession. Large populations withdrew their money in a series of bank runs with the first starting in Nashville, Tennessee in the fall of 1930. The bank run preceded others across the Southeast. Most of the bank runs were triggered by rumors casting doubts on a bank's capability to pay its depositors. An example of this scenario is a New York Times report in December 1930 which involved a merchant spreading rumors about the inability of the Bank of the United States to pay its customers. A crowd congregated at the bank hours later and withdrew $2 million. As bank deposits were uninsured, people simply lost their deposits when they failed. The remaining banks were hesitant to offer new loans which worsened the economic conditions leading to less spending.

Drought Conditions

The early 1920s was a great period for American farmers as new crop varieties and technology reduced the costs and time for farming making cultivation efficient and less costly. Agriculture felt the impact of the depression severely in late 1920. Low crop prices forced farmers to farm more acreage such as poorer farmland and to introduce other crop varieties. These conditions did not get better in the early 1930s. The Great Plain farmers were particularly impacted the hardest by a drought in the early 1930s. The region had been overgrazed and over-farmed for years, and winds raised clouds of dust as they swept away. The dust settled on houses and farm buildings, and caused the sky to darken for days. The drought made it impossible for farmers to settle their debts and taxes, and they resorted to selling their land at losses. The desperate farmers opted to abandon their farmlands and seek work opportunities in the west, and farm transfers became common. This agricultural devastation further worsened the region's economy.

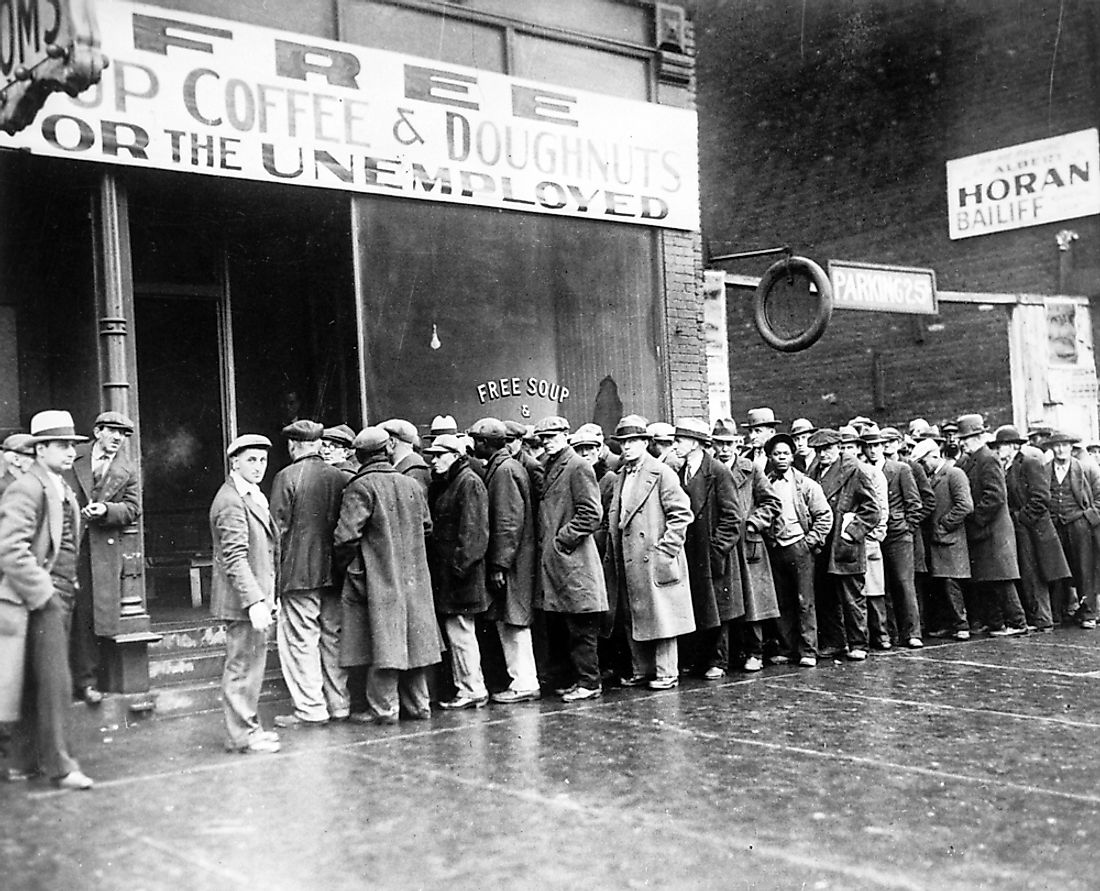

Reduction In Purchasing

Companies and consumers spent less funds due to the reduction of their investments and savings. Credit was also tight and almost impossible to get. The spending affected industrial production as fewer goods were produced, which meant that companies did not need the amount of workforce they did before the depression. Laid-off workers found it tough to keep paying for assets they had purchased via installment plans and repossessions, and evictions thus became common. The unemployment rate peaked at over 25% which translated to even less spending, worsening the economic woes. The poor performance of agriculture reduced the income gap of farmers, making them unable to spend as they did before the depression. Unsold business inventory rose fourfold between 1928 and 1929 which signaled the low purchasing power.

US Economic Policy with Europe

As the depression progressed, the US government began to look for ways to mitigate its effects. In 1930, Congress adopted the Tariff Act (Smoot-Hawley Tariff) to protect the nation's industry from foreign competitors. The act imposed high taxes on a variety of imports. Some American trading partners reacted by imposing tariffs on items made in the US. This situation facilitated the reduction of world trade by two-thirds from 1929 to 1934. Other nations instituted various protectionist policies leading to further breakdown of international trade.

Weak Global Market

The low customer purchasing power in the US was mirrored by a similar situation in Europe. Europe's economy was already suffering in the aftermath of the war, and the depression aggravated the situation. The American farmers had profited enormously from supplying agricultural products to Europe in the aftermath of the war and their inability to supply adequately during the depression further weakened the global market.