The Economy Of Egypt

Overview Of The Economy Of Egypt

The economy of Egypt is moving toward a market-oriented approach after years as a planned economy with import substitution. Under the planned economy, the Egyptian government had total control over resource allocation, including distribution and pricing. It also focused on domestic production rather than importation of foreign goods. As a market-oriented economy, Egypt is implementing structural reforms, encouraging foreign direct investment, and allowing supply and demand to dictate the distribution and pricing of goods. Although, the government does still have some state-owned organizations, like banks. This new economic approach helped Egypt’s economy grow by 8% between 2004 and 2009. However, in 2011, the government underwent a political revolution that left significantly reduced its growth.

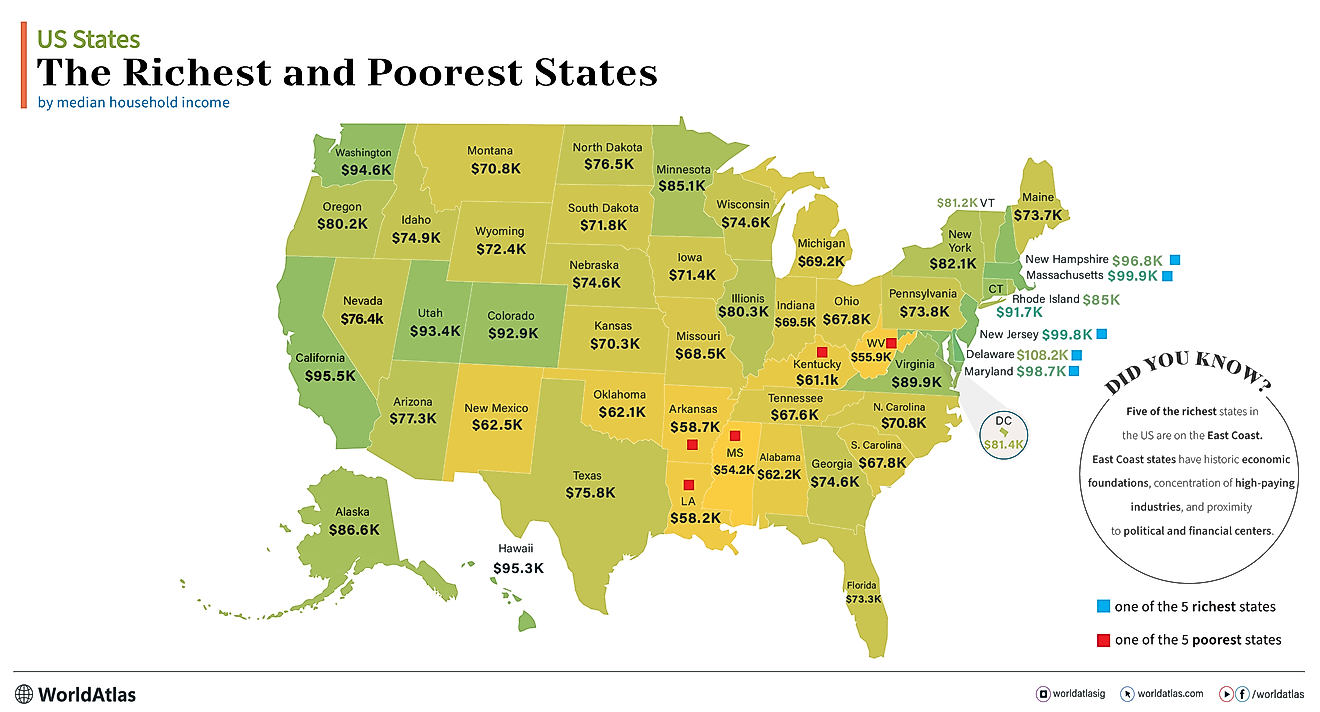

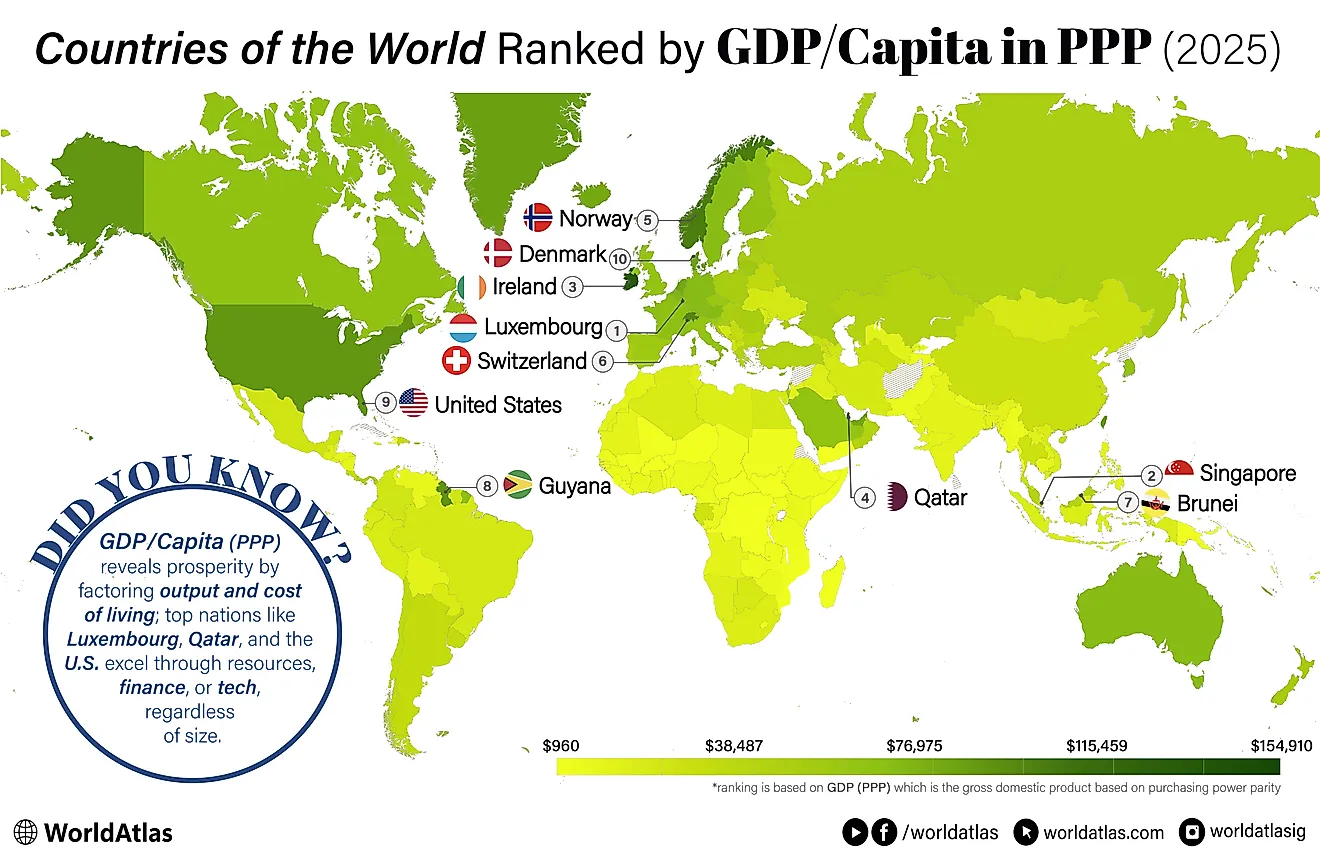

Its nominal gross domestic product (GDP) for 2015 was $330.765 billion, and GDP per capita was around $4,000. It has a workforce of 28.4 million. Of these individuals, approximately 47% work in the service industry. This is followed by 29% in agriculture and 24% in industry.

Leading Industries Of Egypt

The economy of Egypt is based on several industry endeavors. These include tourism, textile production, food processing, hydrocarbons, chemicals, pharmaceutical, construction, cement and metal production, and manufacturing. The textile industry, for example, contributes 25% of non-petroleum based income. The informal sector of the economy is quite large and represents between 30% and 60% of the GDP.

Top Export Goods And Partners

Egypt exported $33.2 billion worth of goods in 2014, making it the 62nd largest export economy in the world. Its principal exports include crude petroleum ($6.84 billion), refined petroleum ($1.34 billion), insulated wire ($996 million), video displays ($757 million), and gold ($667 million). The majority of exports leaving Egypt are imported by the following countries: Italy ($3.28 billion), Germany ($2.03 billion), Saudi Arabia ($1.95 billion), India ($1.86 billion), and Turkey ($1.77 billion).

Top Import Goods And Partners

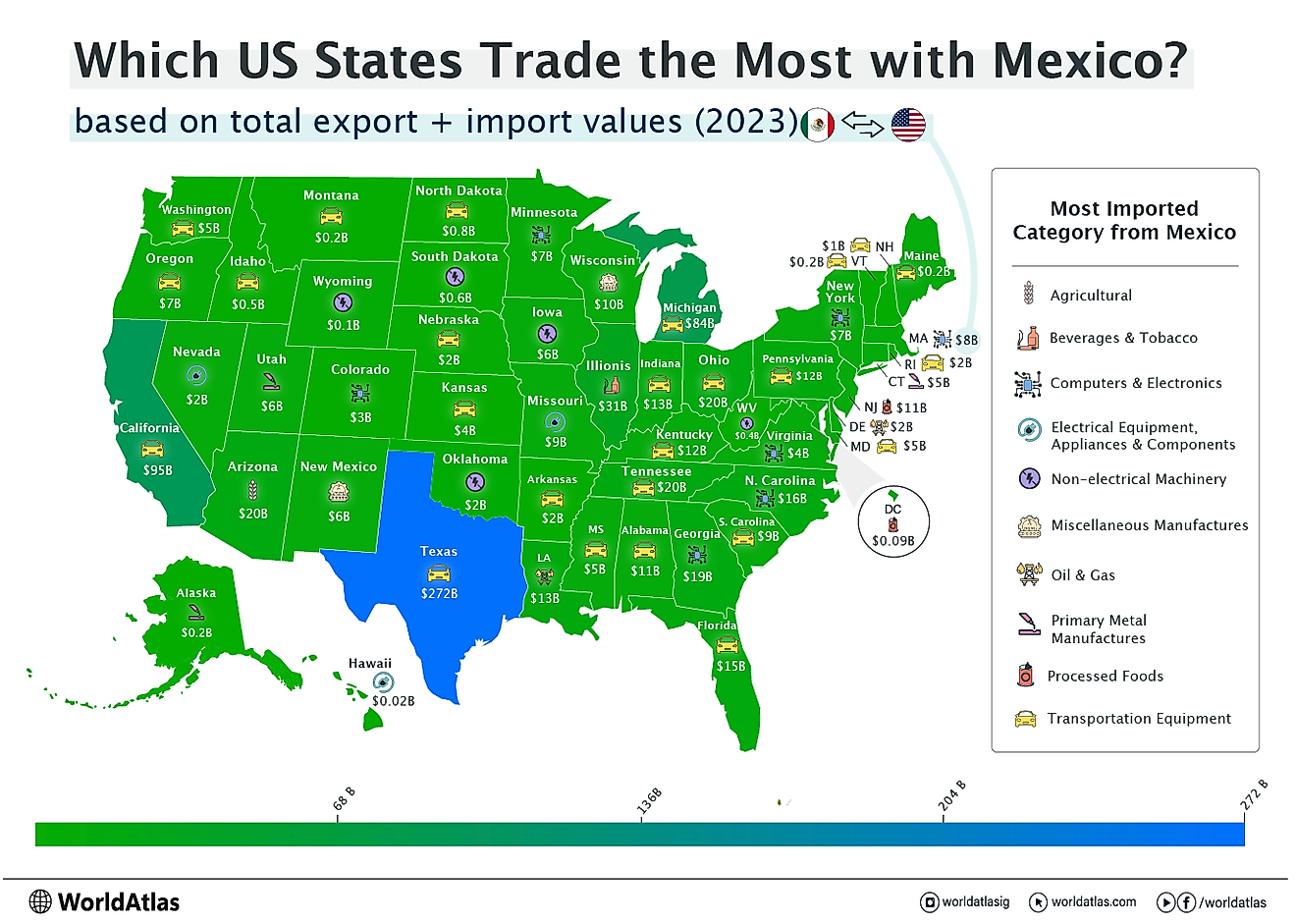

In 2014, the imports to Egypt totaled $82.4 billion, giving the country a negative trade balance of $49.2 billion. This means that Egypt imported more than it exported. Its primary imports are refined petroleum ($7.47 billion), wheat ($5.36 billion), semi-finished iron ($2.9 billion), crude petroleum ($2.79 billion), and cars ($2.27 billion. Its major import partners are the following countries: China ($9 billion), the US ($5.89 billion), Russia ($5.7 billion), Ukraine ($4.6 billion), and Germany ($4.1 billion).

Challenges Faced By The Economy Of Egypt

After the 2011 revolution, the economy of Egypt has suffered a severe downturn. During this time, its foreign exchange reserves decreased from $36 billion at the end of 2010 to only $16.3 billion at the beginning of 2012. With this loss, investor confidence fell, and Standard & Poor further reduced the country’s long-term credit rating from B- to CCC+. The short-term credit rating was reduced from B to C as international banks worried about Egypt’s ability to repay existing and new loans. As foreign investors have turned their backs on the economy of Egypt, the government’s biggest challenge is in promoting growth with limited capital.

Future Economic Plans

Future economic plans of Egypt need to involve restructuring that focuses on sustainable growth. The government has already taken some steps towards economic reform, including cutting government subsidies, increasing fuel prices and electricity rates. Additionally, the government has approved several infrastructure development projects in order to create jobs, which increases salaries and spending. The Egyptian government has also appointed a new economic team, who is in charge of the new economic plan to further attack these challenges. Among its future objectives are: decrease the unemployment rate to less than 9% by 2020, increase growth to between 5% and 6%, reduce inflation to less than 10%.